The Bitcoin price tagged a new yearly high yesterday at $31,840, leaving market participants wondering about the driving forces behind this bullish momentum.

The Power of Economic Indicators

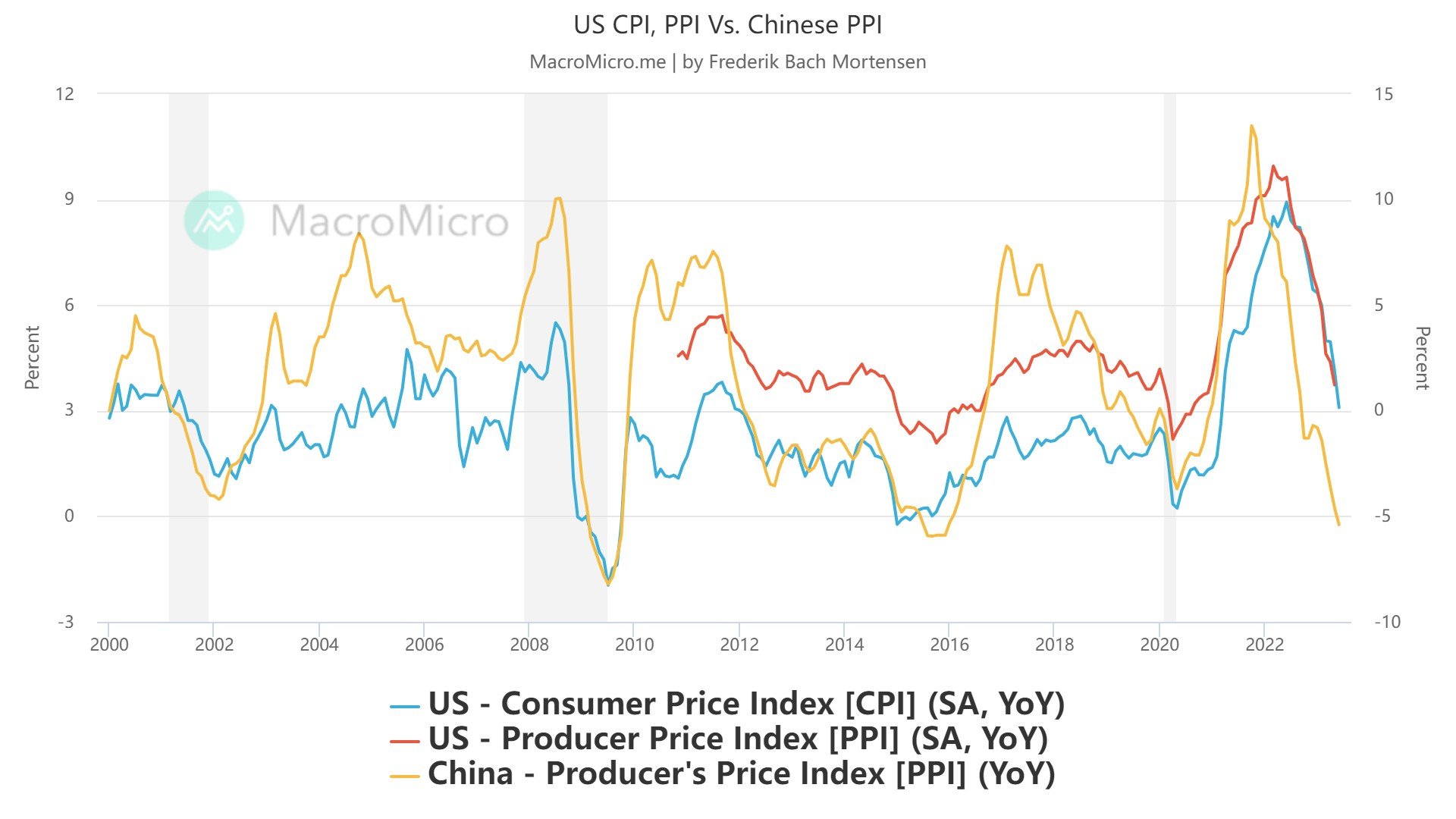

One of the crucial factors contributing to Bitcoin’s upward trajectory was the release of the United States Producer Price Index (PPI) data. The latest figures revealed a significant slowdown in inflation, with PPI YoY dropping to 0.1% in June, surpassing expectations and marking the smallest pace since August 2020. Notably, the Core PPI YoY came in at 2.4%, slightly below the estimated 2.6%, reinforcing the notion of a diminishing inflationary environment.

This decrease in PPI is seen as a positive sign for the Consumer Price Index (CPI), providing hope for a more stable economic landscape. Macro researcher Mortensen Bach emphasized the significance of the PPI’s impact, stating, “PPI always leads CPI. Inflation is no longer a thing and input prices clearly indicate that! Deflation remains the primary risk going forward. This is what happens when you have a Federal Reserve who is blindly focused on backward-looking data!”

Echoing these sentiments, macro analyst Ted added, “PPI inflation leads CPI by a few months… and today’s PPI numbers have YoY running at +0.24%. Almost in deflation! Fed pivot anyone?”

Also worth noting is that, May PPI inflation was revised lower from 1.1% to 0.9%. May Core PPI inflation was revised lower from 2.8% to 2.6%. The drop and revision lower in Core PPI is what the US Federal Reserve wants to see.

Inverse Correlation With The DXY

Another pivotal factor driving Bitcoin’s surge is the recent drop in the US Dollar Index (DXY) below 100.00, a level not seen in 15 months. This development has sparked renewed interest in risk assets like Bitcoin as a hedge against a weakening dollar.

The inverse correlation between the DXY and Bitcoin has historically played a significant role in the cryptocurrency’s price movements, and this recent drop in the DXY has acted as yet another bullish catalyst.

Ripple’s Partial Victory

The ongoing legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC) has probably provided another boost to Bitcoin’s price. Ripple’s partial victory in the case has generated optimism in the crypto community and can be seen as a net positive event for Coinbase, which is embroiled in its own legal dispute with the SEC.

Interestingly, Coinbase serves as the exchange partner for all U.S. Bitcoin spot Exchange-Traded Funds (ETFs) currently filed with the SEC. Recently, chair Gary Gensler’s comments on Coinbase’s involvement in ETF filings have raised concerns about the suitability of the exchange as a market surveillance sharing partner, as Bitcoinist reported.

Eric Balchunas, a Senior ETF analyst for Bloomberg, expressed his apprehension, suggesting that “SSA could be pointless if this is a problem for him.” With this in mind, the Ripple victory can also be seen as extremely positive news for the approval of a Bitcoin spot ETF, as Coinbase could benefit from the ruling in its case against the SEC.

At press time, the BTC price retraced to $31,250, up 2.6% in the last 24 hours.

Featured image from iStock, chart from TradingView.com