The countdown to Bitcoin’s highly anticipated halving event is on, with fewer than 10,000 blocks left as of Feb. 12.

According to the Bitcoin Halving Clock, approximately 9,843 blocks remain before the event, which is estimated to occur by April 17.

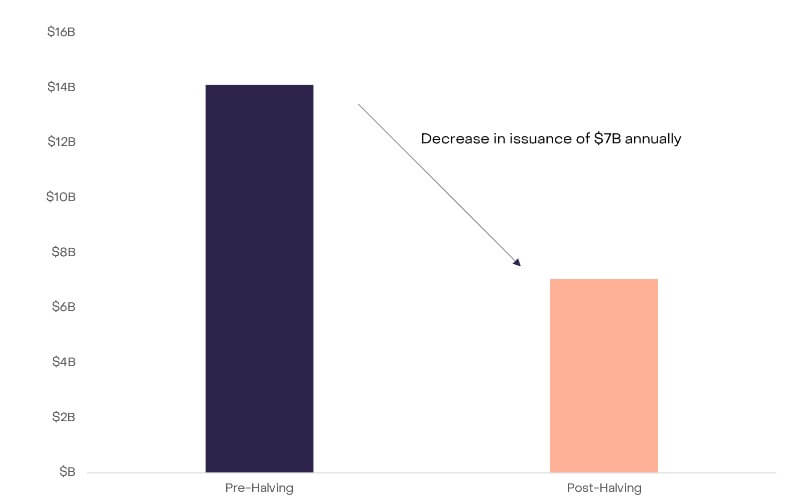

The halving event is significant for the crypto industry because it enhances Bitcoin’s scarcity by reducing miner rewards. CryptoSlate Insight reported that the event would slash the number of BTC produced daily by miners to 450 BTC from 900 BTC.

Historically, BTC halving has usually been followed by an increased difficulty in mining the top crypto asset and a bullish price movement.

Bitcoin upcoming halving is ‘different’

Crypto asset management firm Grayscale said the impending halving event carries distinct implications compared to its predecessors due to the notable surge in BTC’s utility over the past year.

“Despite miner revenue challenges in the short term, fundamental onchain activity and positive market structure updates make this halving different on a fundamental level,” Grayscale wrote.

According to the firm, the recent introduction of Bitcoin Exchange-Traded Funds (ETFs) presents a stable demand outlet that could counteract the downward pressure from mining issuance.

It said:

“ETFs, in general, create access to Bitcoin exposure to a greater network of investors, financial advisors, and capital market allocators, which in time could lead to an increase in mainstream adoption.”

Furthermore, Grayscale highlighted the significance of Non-Fungible tokens (NFTs)-like ordinal inscriptions in the BTC ecosystem. The firm said these assets “present a new path toward sustaining network security through increased transaction fees.”

Beyond that, the emergence of ordinal inscriptions has invigorated on-chain activity, yielding over $200 million in transaction fees for miners as of February 2024. This trend is anticipated to endure, buoyed by renewed developer engagement and ongoing innovations within the blockchain.

In addition, Grayscale noted that miners have been proactively preparing for the halving’s financial implications by liquidating their BTC since late 2023. This proactive stance positions them favorably ahead of the halving event.

Even if some miners were to exit the network, Grayscale said the subsequent decrease in hash rate would prompt an adjustment in mining difficulty, safeguarding network stability.

“While [BTC] has long been heralded as digital gold, recent developments suggest that [it] is evolving into something even more significant,” Grayscale concluded.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is up 3.52% over the past 24 hours. BTC has a market capitalization of $980.27 billion with a 24-hour trading volume of $30.81 billion. Learn more about BTC ›

BTCUSD Chart by TradingView

Market summary

At the time of press, the global cryptocurrency market is valued at at $1.86 trillion with a 24-hour volume of $62.28 billion. Bitcoin dominance is currently at 52.66%. Learn more ›