Yesterday saw the launch of an easy “shorting” provision for users of the DeFi app, shooting the prices of its token by 11%.

You can now short on Synthetix

Decentralized finance app Synthetix (SNX) saw the deployment of the “Bellatrix” update yesterday, as per a release. The update opens up newer on-chain capabilities for users.

Synthetix is one of the crypto market’s “DeFi blue chips.” It allows users to create, manage, and trade synthetic assets—instruments that imitate another investment, such as futures, options, or swaps, or a combination of them all—atop the Ethereum blockchain.

Bellatrix was a major upgrade for Synthetix, as it now allows users to bet against—or go “short” on—crypto assets and profit from the downward movement.

1) Yesterday Synthetix launched a new shorting mechanism, which also includes an SNX incentive — earn SNX for taking (currently) zero-interest shorts against sBTC and sETH! https://t.co/JuK5FvJ0Pu

— Synthetix

(@synthetix_io) February 5, 2021

As per a post, the following assets were offered/developments that occurred as part of the update:

- SIP-101: The introduction of new crypto Synths. This involved the addition of several new cryptocurrency “Synths” and their corresponding Inverse Synths for the following assets: AAVE (AAVE), Uniswap (UNI), Yearn (YFI), Polkadot (DOT), REN (REN), Compound (COMP).

- SIP-108: Shorting rewards. This now incentivizes users with SNX rewards from the synthetixDAO to open shorts against sBTC and sETH.

- SIP-109: Add Synth exchange suspension support. This SIP adds support for the restriction of specific Synth exchanges during market closures without preventing them from being transferred.

- SIP-95: Delist s/iBCH — The delisting of Bitcoin Cash products from Synthetix. This was earlier decided in November 2020 ahead of a “potentially contentious” BCH fork. Community governance decided for delisting, and yet another community governance decided for a reconsideration of that. The latter failed to meet consensus, and the delisting will hence go ahead.

Rewards for stakers

With the launch, the next 4 weeks would see the synthetixDAO pay over 8000 SNX ($168,000) per week to sBTC shorts and 8000 SNX per week to sETH shorts (a total of over $336,000 per week at current prices). Tokens will be distributed on a pro-rata basis.

“The motivation for this is that the debt pool is still heavily skewed toward sBTC and sETH, and in the context of a bull market this skew represents a significant risk to SNX stakers,” said Synthetix in a tweet.

3) The motivation for this is that the debt pool is still heavily skewed toward sBTC and sETH, and in the context of a bull market this skew represents a significant risk to SNX stakers.

— Synthetix

(@synthetix_io) February 5, 2021

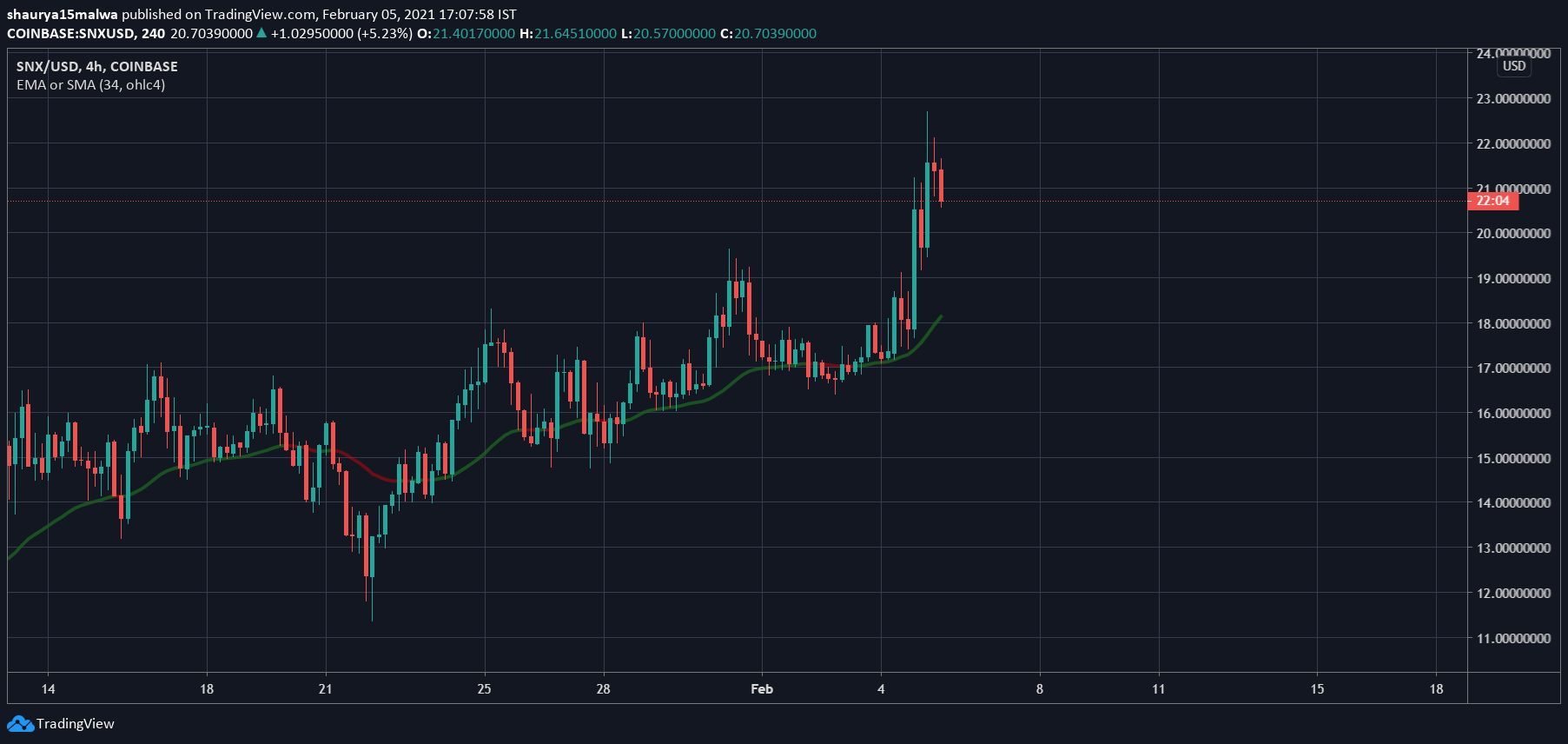

Meanwhile, SNX rose over 11% as the update was rolled out. As seen in the below chart, it trades firmly above its 34-period exponential moving average, a popular tool used by traders to monitor the trend of an asset.

The asset has a $3 billion market cap at writing time with over 147 million SNX tokens in supply.

For more information, explore all DeFi coins on Crypto Finders

The post Synthetix (SNX) ‘Bellatrix’ update makes “shorting” easy for DeFi users appeared first on Crypto Finders

(@synthetix_io)

(@synthetix_io)