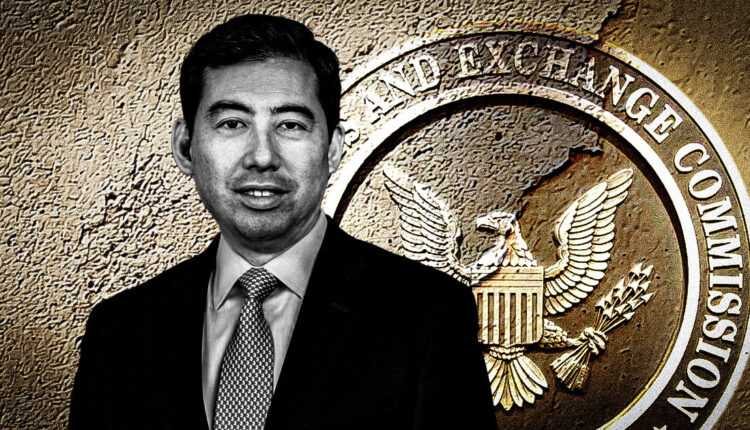

Securities and Exchange Commission (SEC) acting chairman Mark Uyeda has suggested the potential creation of a conditional regulatory sandbox for blockchain-based securities trading.

Uyeda made the remarks during the SEC Crypto Task Force’s second roundtable on April 11, which focused on crypto trading platforms. He proposed a time-limited, conditional exemptive relief framework to support continued innovation while maintaining regulatory oversight.

Such a framework would enable registrants and non-registrants to explore blockchain-based trading solutions without full regulatory approval, subject to compliance with defined conditions.

He encouraged market participants to provide input on how and where such exemptive relief could be implemented most effectively.

Federal framework to enhance crypto trading

Uyeda acknowledged that the first digital asset trading platforms were developed outside federal jurisdiction, often under state-level regulation through money transmitter licenses.

This led to a patchwork of regulatory approaches, with some platforms needing up to 50 different licenses to operate nationally.

He suggested that an “accommodating federal regulatory framework” might streamline compliance for entities offering trading in both tokenized securities and non-security digital assets.

However, existing federal securities laws present barriers to integrating blockchain-based systems into traditional securities markets.

Uyeda cited limitations under current rules for broker-dealers and national securities exchanges, particularly regarding listing requirements and order protection regulations.

Most tokenized securities remain unregistered, making them ineligible for listing on national exchanges. Further complications arise from the structural differences between traditional and crypto trading platforms.

While traditional exchanges separate custody, execution, and clearing, most crypto platforms are vertically integrated entities that combine these functions.

Uyeda noted that the federal securities laws did not anticipate technologies such as blockchain or smart contracts performing roles typically reserved for transfer agents or clearinghouses.

Despite these challenges, Uyeda recognized the operational advantages distributed ledger technology offers. He highlighted blockchain’s potential for real-time collateral management, greater capital efficiency, and continuous trading via decentralized protocols.

He added that these features could offer execution and clearing benefits not present in legacy systems.

The post SEC acting chair signals support for regulatory sandbox to facilitate crypto trading innovation appeared first on Crypto Finders