The Ordinals Protocol has enabled NFTs and BRC-20 tokens on the Bitcoin network – whereas previously, it was a single-asset network.

However, the issue has sparked debate, with critics pointing to soaring transaction fees and chain bloat. In contrast, advocates argue that the concept of permissionless also encompasses the freedom to use Bitcoin as one chooses.

Glassnode data analyzed by CryptoSlate revealed that the good times have returned for miners due to the impact of the Ordinals Protocol.

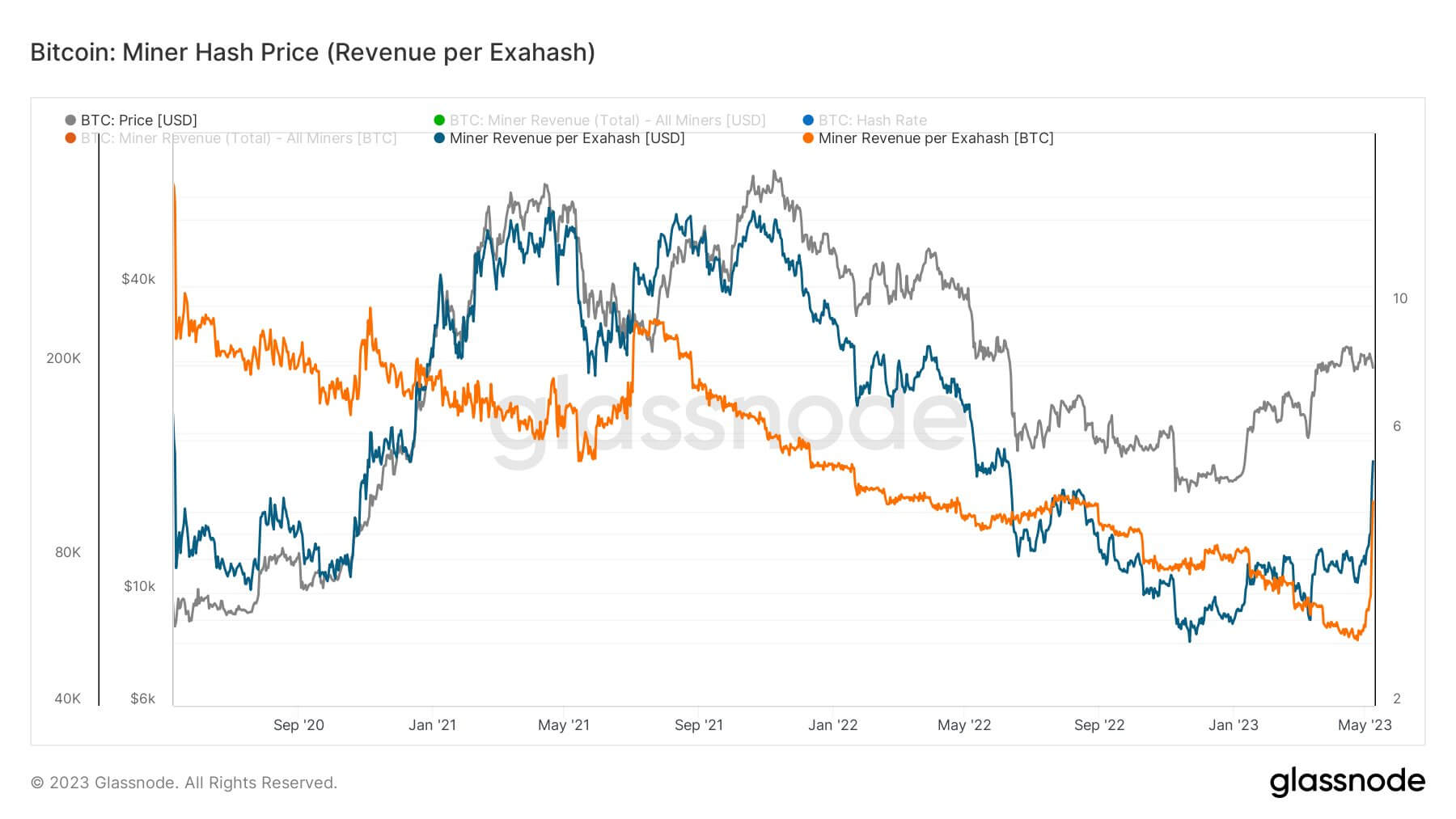

Bitcoin Miner Hash Price

Miner Hash Price refers to the ratio of daily revenue and mining hash rate, giving revenue generated on an exahash (EH/s) basis. It can gauge miners’ “comfort” as a going concern in relation to other miners.

The chart below shows Miner Hash Price has been soaring since May – approaching one-year highs last seen in June 2022. Before this, Miner Hash Price was on a two-year downtrend – which saw a reprieve with the Terra LUNA implosion before continuing the downtrend some four months later.

With daily income rising relative to mining contribution, miners are experiencing a boon thanks to the decreasing average cost of producing Bitcoin.

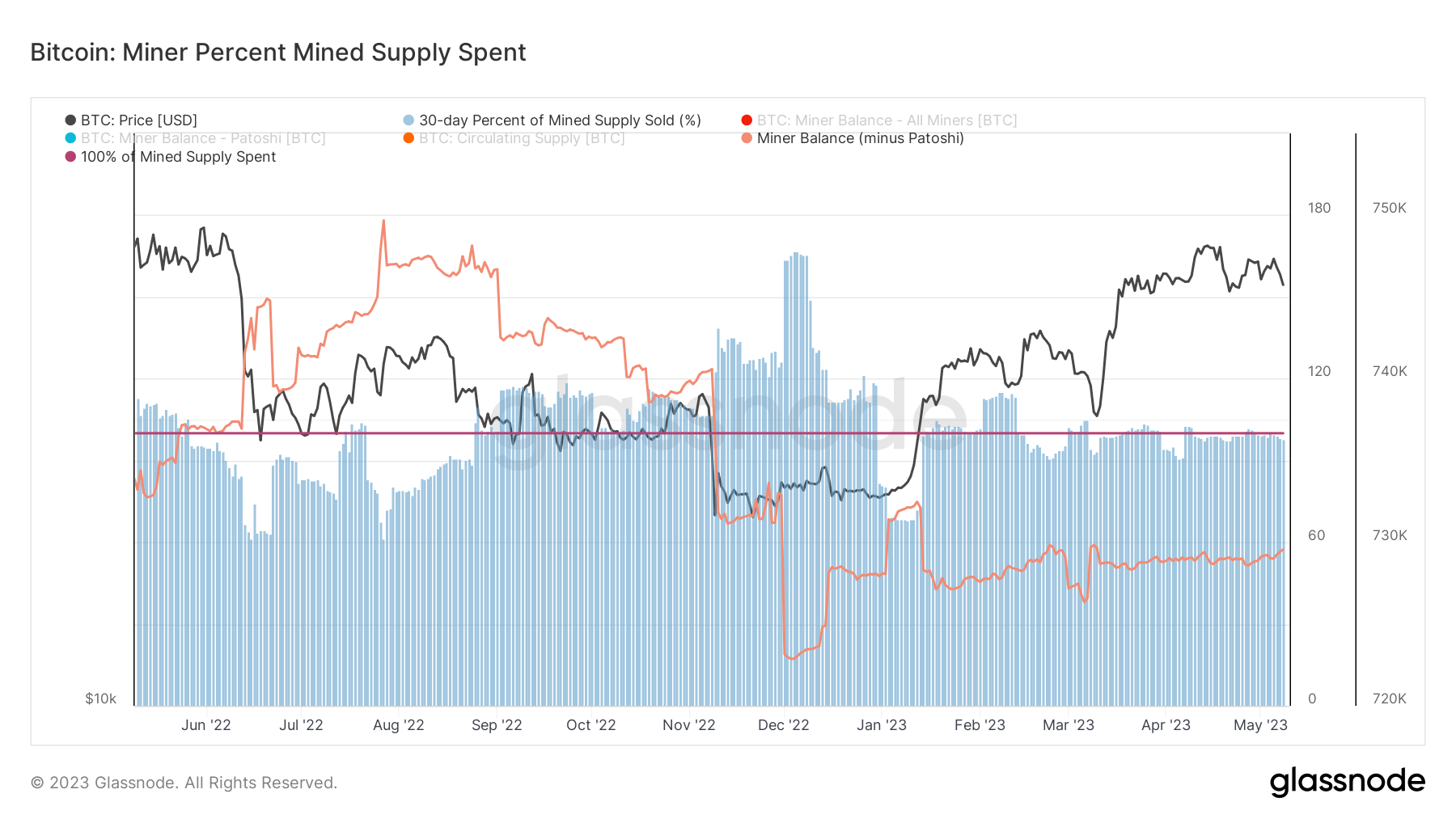

Miner Percent Mined Supply Spent

Miner Percent Mined Supply Spent refers to an estimate of the percentage of mined supply that is spent by miners over a 30-day window.

The model compares the 30-day change in miner balance and the 30-day total issuance to determine the proportion of mined coins spent to give the following three variables at a particular point in time:

- 100% – indicates that the volume of mined coins equals the total mined supply spent in the aggregate.

- Less than 100% – miners retain a portion of mined supply in treasury reserves.

- More than 100% – miners are distributing coins in excess of the mined supply, thus depleting treasury reserves.

The chart below shows that the Miner Balance (minus Patoshi) currently reads 729,554 BTC. While this is significantly less than the July 2022 peak of 750,000 BTC, the balance still signifies a notable uptick from December 2022 lows, which bottomed at 722,000 BTC.

Moreover, the year-to-date pattern shows an overall uptrend, indicating miners feel confident of future price increases – leading them to prefer holding mined coins as balance sheet assets rather than selling.

Patoshi refers to the coins mined by Satoshi Nakamoto during the period he was actively involved with Bitcoin development. On-chain data shows he holdings 1.096 million coins – which remain untouched.

Combined with analysis that suggested miner capitulation occurred last year, CryptoSlate expects to see the Miner Balance uptrend continue – leading to a favorable period ahead for miners.

Summary of Ordinals impact over the past week

Since the start of this week, meme coin mania saw BRC-20 tokens trigger a 24-month high in transaction fees.

This meant block 788695, written on May 7, earned a transaction fee of 6.701 BTC, making it the first block in history where the transaction fee exceeded the mining reward (currently 6.25 BTC).

Likewise, meme coin FOMO led to the BRC-20 market cap surpassing $1 billion on May 8. However, extreme downside volatility has since seen a significant drawdown. As a result, the current BRC-20 market cap comes in at $735.6 million.

The number of Inscriptions, digital artifacts inscribed on the Bitcoin blockchain, approached five million – resulting in miners earning a cumulative fee of 904 BTC.

The post Research: Ordinals, BRC-20 drive financial boon for Bitcoin miners appeared first on CryptoSlate.