For the month of June 2022, the US Bureau of Labor Statistics published its Consumer Price Index. The Negative CPI was found to be 9.1%, the largest inflation increase in the US in the previous 40 years. The Federal Reserve’s monetary policy is determined by the CPI, which is a reliable indicator of inflation.

Negative CPI Report Causes Bitcoin To Tumble

Prior to the release of U.S. inflation statistics on July 12, the price of Bitcoin (BTC) settled into a solid holding pattern, which ultimately added more negative volatility.

According to the latest CPI report for June, inflation in the United States reached 9.1%, which is the highest level since November 1981. This news only served to accelerate the downward trend in Bitcoin and the cryptocurrency market.

Following the release of the CPI, BTC falls by around 4% within ten minutes. Traditional market gauges like the S&P 500, Dow Jones, and NASDAQ are all sharply lower.

According to TradingView data, Bitcoin is currently trading at $19,180, down 3.45% on the day and 4.70% for the past week, with a total market cap of $366 billion. Notably, the flagship digital asset lost $15 billion from its market capitalization, dropping from $379.91 billion to $364.55 billion.

Bitcoin market cap at $374 Billion. Source: TradingView

The CPI for the previous month revealed an increase in inflation of 8.6% year over year, the highest level since 1981. The Fed implemented quantitative tightening monetary policies in response to extremely high inflation.

The entire crypto industry saw a severe downturn as a result of the Fed’s hardline monetary policy. The last ten years’ worst financial quarter for Bitcoin was experienced.

Related Reading | Wall Street Investors Expect Bitcoin To Hit $10,000, Is This Possible?

This revelation may have severe effects for the cryptocurrency markets, if last month’s CPI is any indicator.

Investors took a collective deep breath as the time for the release of the inflation statistics ticked down. The global markets remained calm, but as many prominent crypto trading analysts had hinted at the start of the week, an announcement—positive or negative—would be said to have a significant impact on the price of digital assets.

The United States Federal Reserve will be under even more pressure to raise interest rates as a result of the inflation statistics, which was much higher than expected.

More Pressure

Since Bitcoin has so far been unable to act as an inflation hedge, it has experienced a considerable loss in value this year, plummeting by around 72%. Along with other risk assets, Bitcoin has been severely impacted by the Fed’s monetary policies because it has always existed in a low-interest rate environment.

The Federal Reserve would be able to pull off a soft landing, so avoiding a recession while significantly raising interest rates, according to strong job numbers that were reported last week. Despite the fact that interest rates have been sharply climbing, this was the case.

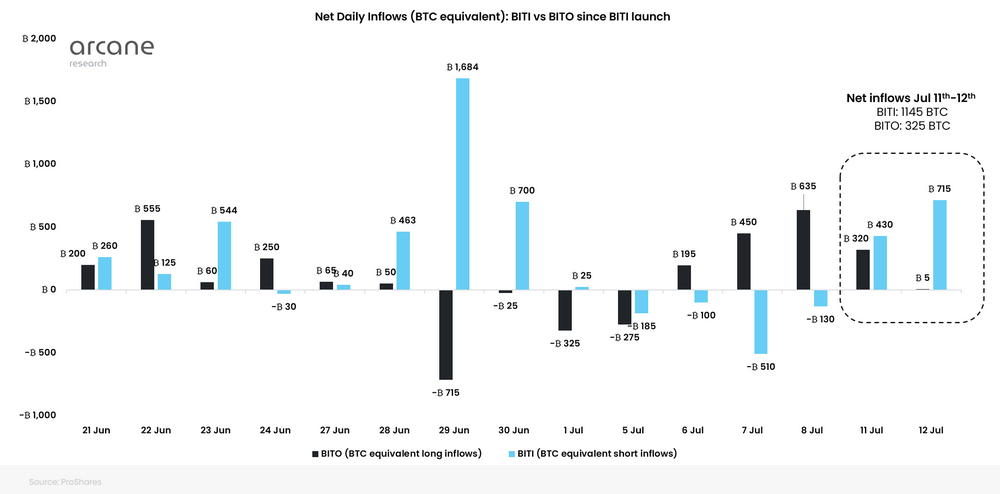

Crypto traders and investors were heavily shorting Bitcoin and other cryptocurrencies before to the long-awaited data’s release because netflow to exchange-traded funds that give investors exposure to short Bitcoin reported roughly $15 million in inflows in only one day.

Source: Arcane Research

The founder of Eight Global, Michal van de Poppe, stated that the CPI will determine whether or not Bitcoin succeeds. The support level of $19.5K and resistance level of $19.8K present a significant test for BTC. Depending on the CPI, BTC is anticipated to experience a significant decline.

Related Reading | Glassnode: Bitcoin LTHs Who Bought During 2017-2020 Aren’t Selling Yet

Featured image from Shutterstock, charts from TradingView.com and Arcane Research