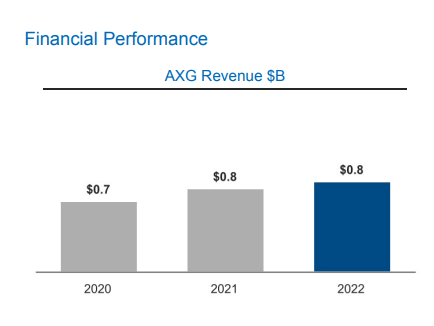

Intel announced the end of first-gen Blockscale 1000-series Bitcoin-mining ASICs on April 18, despite the chips contributing both efficiency and a rise in revenue in 2022 — up from 2021.

The announcement — initially reported by Tom’s Hardware — cited “a tighter focus on its IDM 2.0 operations” as the rationale behind the decision to discontinue the chips.

However, the chip was part of the Accelerated Computing Systems and Graphics Group (AXG) revenue segment — which registered a $63 million increase in 2022 in comparison to 2021.

Efficient but not cost-efficient

Intel Blockscale 1000-series chips were deployed by at least one public Bitcoin (BTC) mining company through 2022 and shown to be both efficient and profitable.

In December 2022, Canadian Bitcoin mining firm Hive Blockchain mined a total of 213.8 BTC — worth $3.15 million — utilizing Intel Bitcoin-mining ASICs to do so.

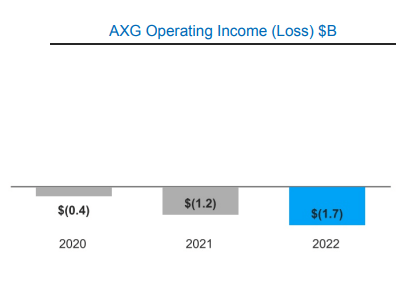

However, despite the improvement in efficiency and profitability offered by Intel’s Blockscale 1000-series chips, Intel operating income costs Year-on-Year (YOY) increased almost 50% to $1.7 billion in 2022, from $1.2 billion in 2021.

These operating costs were “due to increased inventory reserves taken and investments” in Intel’s product roadmap, according to the company’s annual report.

Committing to “delivering five technology nodes in four years” in 2022 — one of which was the first Intel Blockscale ASIC — Intel sought to accelerate its IDM 2.0 strategy by “investing in manufacturing capacity around the world.”

Intel noted that its 2022 results were “impacted by an uncertain macroeconomic environment arising from inflation, the war in Ukraine, and COVID-19 shutdowns in [its] supply chain in China.”

Causation of the discontinuation

Intel’s reasoning behind the discontinuation of its Bitcoin-mining chips is supported by the extra $500M in operating costs YoY in 2022 — lending further rationale to the finality of the company’s decision.

On the subject of the IDM 2.0 strategy, the firm said:

“Though we aggressively adjusted capital investments in 2022 to respond to changing business conditions, we still made significant investments in support of our IDM 2.0 strategy during the year.”

The post Intel Bitcoin mining chips discontinued despite chip efficiency, $63M revenue boost in 2022 appeared first on CryptoSlate.