The tiny Himalayan nation of Bhutan has never been a stranger to Bitcoin. Still, the latest bombshell report from Forbes shed light on the scope of the Kingdom’s secretive mining operation.

The Kingdom itself upended an investigation into Bhutan’s alleged mining scheme when it confirmed to a local newspaper that it was engaged in mining digital assets. The CEO of Druk Holding & Investments (DHI), Bhutan’s state-owned holding company, said that the company entered the mining space “a few years ago” when the price of BTC was around $5,000.

This aligns with information leaked by sources familiar with the matter, who told Forbes that the country has been developing sovereign mining operations since at least 2020.

However, Bhutan’s involvement in the crypto industry doesn’t stop there.

Behind Bhutan’s growing mining operation

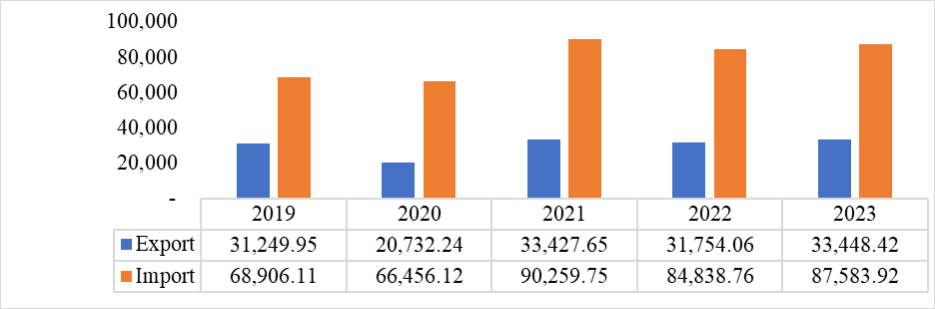

First suspicions about the country’s involvement with mining began in 2021 when the Department of Revenue and Customs reported importing $51 million worth of “processing units.” This was a significant spike from the $1.1 million worth of these units imported in 2020. In 2022, the country imported $142 million worth of computer chips, representing just over 10% of its total inbound trade and 15% of its $930 million annual budget.

According to the Ministry of Finance’s 2022 macroeconomic report, total imports in 2022 increased by 35.8% compared to 2020. The primary driver of this growth was “processing and storage units” DHI imported for “special projects.”

Further investigation found that Bhutan classified these processing units under the same export labels used by Bitcoin mining hardware manufacturers in Asia. Official data showing almost all of these units were sourced from Hong Kong and China confirmed suspicions that these were, in fact, ASIC miners.

The country’s involvement with mining was confirmed again in Bitdeer’s recent SEC filing. The NASDAQ-listed company disclosed that out of the 500 MW increase in power supply planned for this year, around 100 MW will come from Bhutan.

“We expect to generate 100 MW out of the 550 MW power supply from Bhutan, where the construction of the mining data center is expected to begin in the second quarter of 2023 and complete in the third quarter of 2023.”

Bitdeer is among the largest Bitcoin miners in the world, with its total hash rate putting it on par with Core Scientific, Riot, and Marathon. Around 25% of Bitdeer’s hash rate capacity is used for self-mining, with the rest used for cloud mining. Neither Bitdeer nor Bhutan has commented on the matter, so it remains unclear who will use and own the additional hash rate.

Confidential sources also revealed that Bhutan’s government has been in talks with other mining companies besides Bitdeer. Sources at other mining services and pools said they held “advanced talks” with senior government officials, including representatives from DHI, about building and operating a hydro-powered mining operation in Bhutan. The country also hired consultants to advise it on its mining strategy. They told Forbes that Bhutan had been inquiring about “a 100 MW operation hooked to a hydroelectric plant” before Bitdeer’s announcement.

Bhutan also seems to have been involved in an active effort to bring more independent miners into the country. The Singapore Bhutan Association, a club of several businessmen from China and Singapore backed by a member of the Bhutanese royal family, pitched a lucrative mining operation to outside investors last year. The pre-installed containers would be equipped with 250 ASIC T17+ miners providing around 700 kW of electricity. The return on an $800,000 investment for a single container would take between 12 and 18 months, and the company would keep 10% of the mined coins to cover maintenance and foundation costs.

Dasho Ugen Tsechup Dorji, vice chairman of the Singapore Bhutan Association and uncle of Bhutan’s king, told Forbes the project was on hold. He said that the government of Bhutan hasn’t approved “the private sector to get involved in this business.” Humphrey Chan, a board member of the Association, said that the collapse of FTX and logistical issues “had soured investor interest.”

Financing the fourth industrial revolution in Bhutan

Despite Bhutan’s success in preventing a widespread pandemic, the tiny landlocked state suffered devastating economic consequences following its two-year isolation. While it’s unclear whether this was the main driver of its effort to ramp up mining, its involvement with the crypto industry indeed increased in the past two years.

Sources familiar with the matter told Forbes that the pandemic was indeed a trigger for senior Bhutan officials to begin talks with miners and mining suppliers.

Court documents reviewed by Forbes revealed Druk Holding & Investments was a customer of BlockFi and Celsius. In February 2023, BlockFi served a complaint to DHI, accusing the fund of defaulting on a $30 million loan repayment. DHI reportedly borrowed 30 million USDC in February 2022, depositing 1,888 BTC as collateral. The complaint alleges that DHI “failed and refused” to repay the loan even after BlockFi liquidated the collateral, which was worth around $76.5 million at the time of the loan, leaving an unpaid balance of about $830,000.

In October 2022, Celsius released records showing DHI was one of its institutional customers. The documents showed DHI and another account called the “Druk Project Fund” deposited, withdrew, and borrowed BTC, ETH, USDT, and other cryptocurrencies between April and June 2022. In the three months shown in the Celsius filing, Forbes reported that Druk withdrew more than $65 million and deposited nearly $18 million in digital assets.

Ujjwal Deep Dahal, the CEO of DHI, said that the borrowed funds were used to “make certain investments” and that “everything has been paid back and settled with no dues.”

DHI claims that it didn’t lose any money on the loans from Celsius and BlockFi, with Dahal implying that the fund used revenues from its Bitcoin mining operation to cover losses.

Bhutan’s secretive foray into the crypto industry has been criticized by many. It appears that DHI failed to disclose any of its involvement with Celsius and BlockFi, and the Ministry of Finance never revealed the purpose of the $142 million worth of computer chips it imported.

While some criticized the secrecy, many seem more worried about the volatility of the crypto market and its potential effects on the country’s struggling economy.

Dahal said that DHI holds a diverse portfolio and doesn’t believe the risk of mining and managing cryptocurrencies is larger than the risk associated with any other asset class. The company believes it mitigated the majority of the risk associated with cryptocurrencies as it doesn’t engage in trading but mines cryptocurrencies “at a relatively low cost using green energy.”

Mining is part of DHI’s “future-facing investment strategy” to support what the country calls the fourth industrial revolution. Bhutan’s economic stagnation has caused a large wave of migration, and the government has been ramping up efforts to develop a competitive tech industry that could make it economically self-sufficient.

The post Inside Bhutan’s secretive Bitcoin mining operation appeared first on CryptoSlate.