A crypto pundit and Bitcoin maximalist, Mark Harvey, has explained why he believes the foremost cryptocurrency Bitcoin, is far off from its true potential. According to him, the crypto token could be worth close to $17 million in the future.

Why One Bitcoin Could Worth $17 Million

In a post shared on his X (formerly Twitter) platform, Harvey made a strong case for Bitcoin on why it could on why a price even greater than $17 million is likely. He referred to Bitcoin’s use case as a store of value and how it could further chop into the market share of other asset classes. He noted Bitcoin’s “tremendous upside” despite being a relative newcomer.

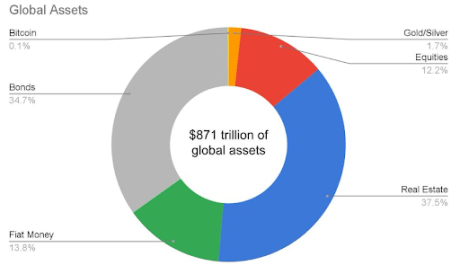

Bitcoin is said to have 0.1% of the $871 trillion which are invested in global assets. Other global assets that hold a substantial market share include gold and silver, bonds, equities, real estate, and fiat money. Harvey believes that Bitcoin’s price could rally significantly as the foremost cryptocurrency becomes the most preferred option for people to preserve their money.

Source: X

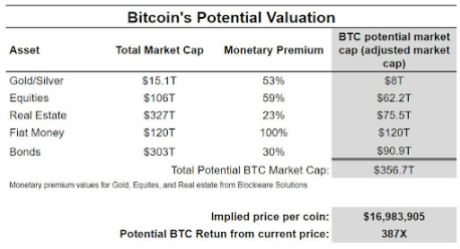

Harvey stated that the monetary premium of those global assets highlights how much they are used as a store of value. The crypto pundit asserts that Bitcoin has the potential to capture the monetary premiums of other asset classes, which would see its price rise to $17 million with a market cap of $356.7 trillion.

Source: X

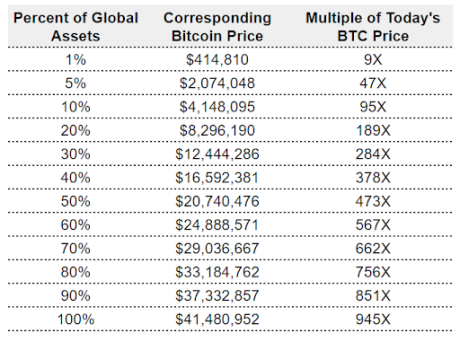

In his opinion, this is very likely because Bitcoin is a “superior form of property.” If it does happen, the crypto token could also end up capturing 41% of the $871 trillion in global assets. Harvey also provided a more probable scenario as to Bitcoin’s future price. He noted that the crypto token could still rise to as high as $415,000 per token if it captures 1% of global assets.

Source: X

Is BTC Superior To Other Asset Classes?

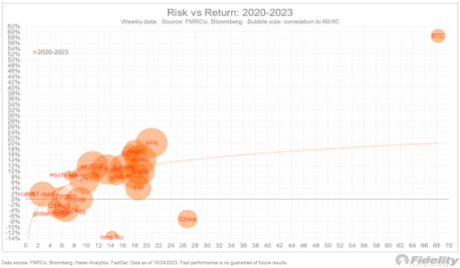

Harvey labeled Bitcoin as a “superior form of property,” and there is evidence to back up this assertion. As highlighted by the Director of Global Macro at Fidelity Investments, Jurrien Timmer, Bitcoin stands out in comparison to other asset classes.

Source: Fidelity Investments

According to data from Fidelity, the flagship cryptocurrency provided the best risk-reward with a 58% return from 2020 to this year. In terms of drawdowns and rallies, Bitcoin also stood out with an 84% gain from its 2-year low.

Meanwhile, a recent report by Glassnode noted that Bitcoin continues to lead as one of the best-performing global assets, with a gain of over 140% year to date (YTD). Specifically, Bitcoin has more than doubled in relation to Gold.

BTC price remains above $43,000 | Source: BTCUSD on Tradingview.com

Featured image from Coin Culture, chart from Tradingview.com

Source: Fidelity Investments

Source: Fidelity Investments