In his latest essay titled “Black or White?”Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX, lays out an analysis predicting that Bitcoin could soar to $1 million. Hayes argues that forthcoming US economic policies under the second term of Donald Trump could set the stage for unprecedented Bitcoin growth.

Hayes draws parallels between the economic strategies of the United States and China, coining the term “American Capitalism with Chinese Characteristics.” He suggests that, similar to China’s approach under Deng Xiaoping and continued by Xi Jinping, the US is moving toward a system where the government’s primary goal is to retain power, regardless of whether policies are capitalist, socialist, or fascist.

Why The Fiat System Is Broken

“Similar to Deng, the elite that rule Pax Americana care not whether the economic system is Capitalist, Socialist, or Fascist, but whether implemented policies help them retain their power,” Hayes writes. He emphasizes that America ceased being purely capitalist in the early 20th century, noting, “Capitalism means that the rich lose money when they make bad decisions. That was outlawed as early as 1913 when the US Federal Reserve was created.”

Hayes critiques the historical shift from “trickle-down economics” to direct stimulus measures, particularly those implemented during the COVID-19 pandemic. He distinguishes between “QE for the rich” and “QE for the poor,” highlighting how direct stimulus to the general population spurred economic growth, whereas quantitative easing primarily benefited wealthy asset holders.

Related Reading

“From 2Q2020 until 1Q2023, Presidents Trump and Biden bucked the trend. Their Treasury departments issued debt that the Fed purchased using printed dollars (QE), but instead of handing it out to rich [individuals], the Treasury mailed checks out to everyone,” he explains. This led to a decrease in the US debt-to-nominal GDP ratio, as the increased spending power of the average citizen stimulated real economic activity.

Looking ahead, Hayes anticipates that Trump’s return to power will usher in policies focused on re-shoring critical industries to the US, financed by expansive government spending and bank credit growth. He references Scott Bassett, whom he believes will be Trump’s pick for Treasury Secretary, noting that Bassett’s speeches outline plans to “run nominal GDP hot by providing government tax credits and subsidies to re-shore critical industries.”

“The plan is to run nominal GDP hot by providing government tax credits and subsidies to re-shore critical industries (shipbuilding, semiconductor fabs, auto manufacturing, etc.). Companies that qualify will then receive cheap bank financing,” Hayes states.

He warns that such policies would lead to significant inflation and currency debasement, adversely affecting holders of long-term bonds or savings deposits. To hedge against this, Hayes advocates for investing in assets like Bitcoin and gold. “Instead of saving in fiat bonds or bank deposits, purchase gold (the boomer financial repression hedge) or Bitcoin (the millennial financial repression hedge),” he advises.

Related Reading

Hayes supports his argument by analyzing the mechanics of monetary policy and bank credit creation. He illustrates how “QE for the poor” can stimulate economic growth through increased consumer spending, as opposed to “QE for the rich,” which inflates asset prices without contributing to real economic activity.

“QE for poor people stimulates economic growth. The Treasury handing out stimmies encouraged the plebes to buy trucks. Due to the demand for goods, Ford was able to pay its employees and apply for a loan to increase production,” he elaborates.

Furthermore, Hayes discusses potential regulatory changes, such as exempting banks from the Supplemental Leverage Ratio (SLR), which would enable them to purchase an unlimited amount of government debt without additional capital requirements. He argues that this would pave the way for “infinite QE” directed at productive sectors of the economy.

“If Treasuries, central bank reserves, and/or approved corporate debt securities were exempted from the SLR, a bank could purchase an infinite amount of debt without having to encumber themselves with any expensive equity,” he explains. “The Fed has the power to grant an exemption. They did just that from April 2020 to March 2021.”

How Bitcoin Could Reach $1 Million

Hayes believes that the combination of aggressive fiscal policies and regulatory changes will result in an explosion of bank credit, leading to higher inflation and a weakening US dollar:

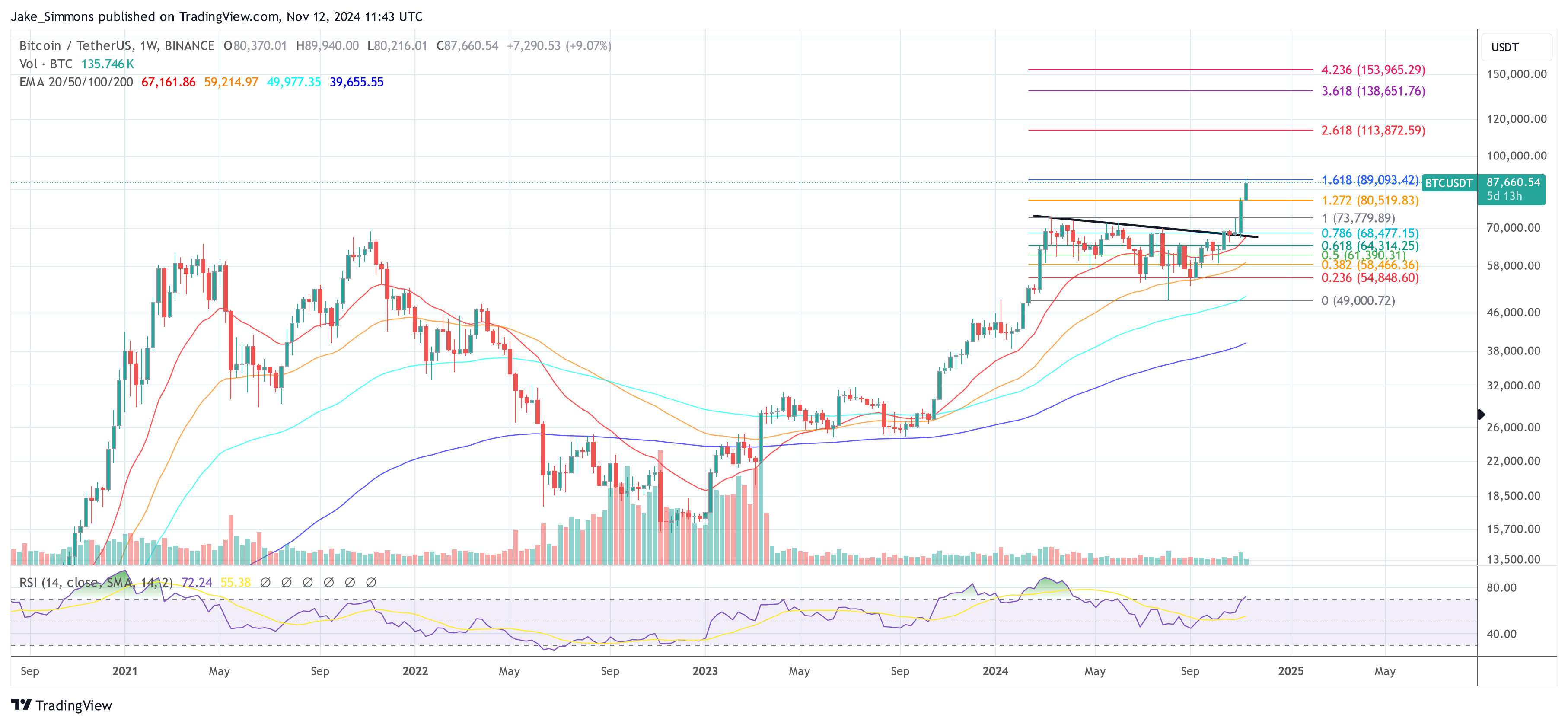

The combination of legislated industrial policy and the SLR exemption will result in a gusher of bank credit. I have already shown how the monetary velocity of such policies is much higher than that of traditional QE for rich people overseen by the Fed. Therefore, we can expect that Bitcoin and crypto will perform as well, if not better, than they did from March 2020 until November 2021.

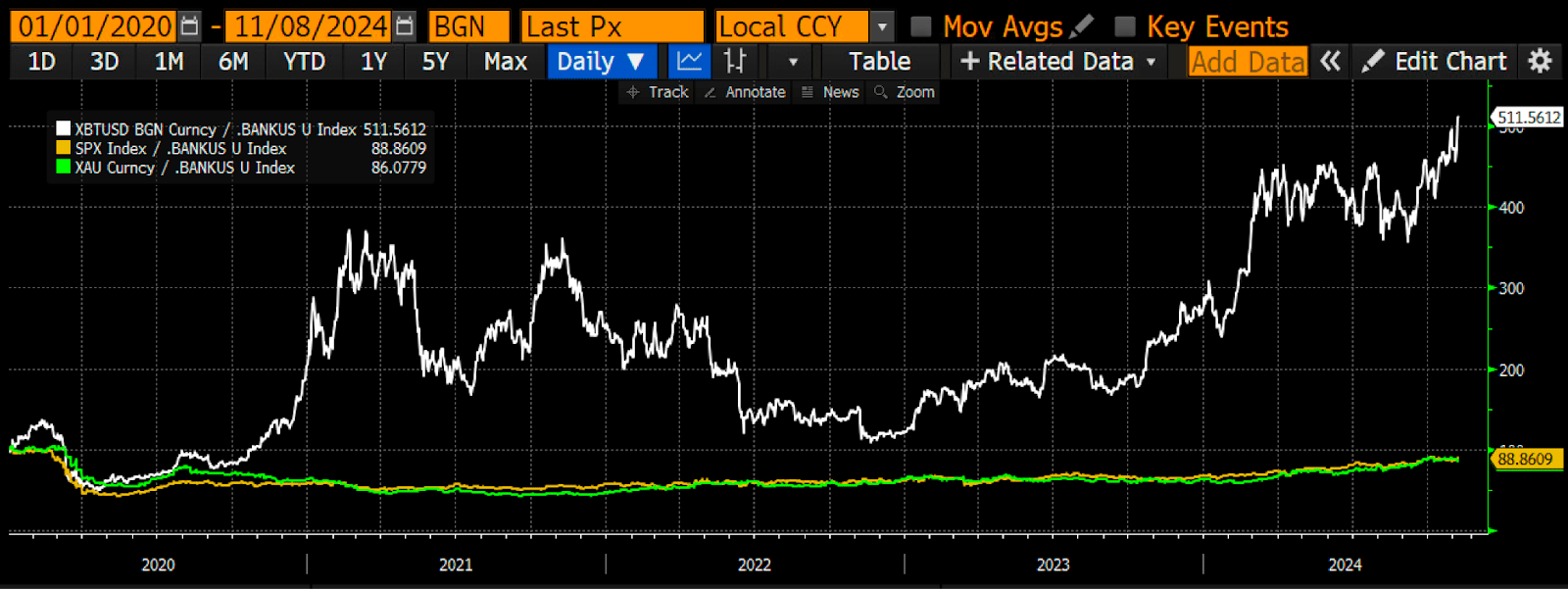

In such an environment, he asserts that Bitcoin stands to benefit the most due to its scarcity and decentralized nature. “This is how Bitcoin goes to $1 million, because prices are set on the margin. As the freely traded supply of Bitcoin dwindles, the most fiat money in history will be chasing a safe haven,” he predicts. Hayes backs this claim by referencing his custom index that tracks US bank credit supply, demonstrating that Bitcoin has outperformed other assets when adjusted for bank credit growth.

“What is [..] important is how an asset performs when deflated by the supply of bank credit. Bitcoin (white), the S&P 500 Index (gold), and gold (green) have all been divided by my bank credit index. The values are indexed to 100, and as you can see, Bitcoin is the standout performer, rising over 400% since 2020. If you can only do one thing to counter the fiat debasement, it is Bitcoin. You can’t argue with the math,” he asserts.

In concluding his essay, Hayes urges investors to position themselves accordingly in anticipation of these macroeconomic shifts. “Get long, and stay long. If you doubt my analysis of the impact of QE for poor people, just read up on the Chinese economic history of the past thirty years, and you will understand why I call the new economic system of Pax Americana, “American Capitalism with Chinese Characteristics,” he advises.

At press time, BTC traded at $87,660.

Featured image from YouTube, chart from TradingView.com