On-chain data shows the percentage of the Bitcoin supply in loss has surged to almost 50% now as the crypto’s price tumbles below $20k.

49.94% Of The Total Bitcoin Supply Is Now Holding Some Loss

As pointed out by an analyst in a CryptoQuant post, the drop below $20k has now put almost 50% of the supply underwater.

The “percent supply in loss” is an indicator that measures what part of the total Bitcoin supply is currently in the red.

The metric works by checking the transfer history of each coin on the chain to see what price it was last moved at.

If the previous selling price of a coin was more than the current BTC price, then that particular coin is being held at some loss right now.

Related Reading | Bitcoin Long-Term Holders Now Own Nearly 80% Of Realized Cap

On the other hand, if the coin was last moved at a lower price than now, then the coin is in profit instead. The supply in loss naturally only counts the former type of coins.

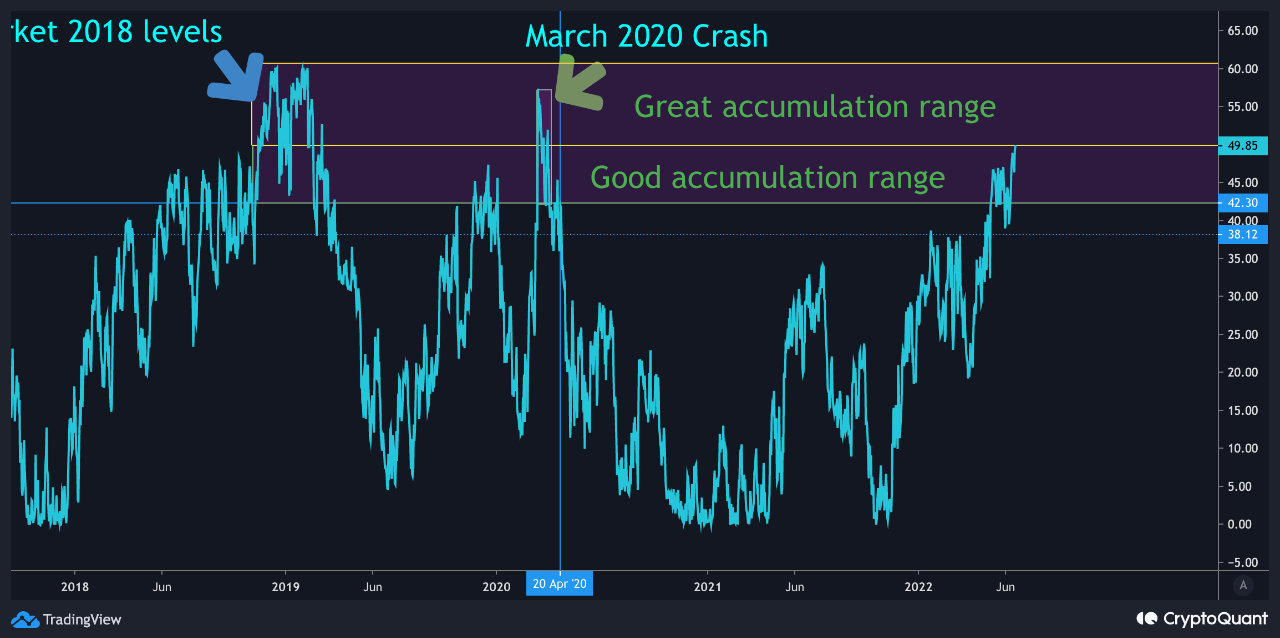

Now, here is a chart that shows the trend in the Bitcoin supply in loss over the last few years:

Looks like the value of the indicator has been rising up recently | Source: CryptoQuant

As you can see in the above graph, the percentage of the Bitcoin supply in loss has been going up in recent weeks as the price has been crashing down.

The latest drop in the value of the crypto, which has now taken it below the $20k level, has pushed a further amount of supply underwater.

Related Reading | Mike McGlone Says $20,000 Is The New $5,000 For Bitcoin, But Is He Right?

Now, the total percentage of the supply in the red has reached very nearly 50%. Historically, periods with value of the indicator between 50% to 60% have been when the coin has observed bottoms before.

Because of this, the range may be ideal for accumulating Bitcoin. However, a real bottom may still have some ways to go as the supply in loss has only just now reached the 50% mark.

During the last two bottoms, the value of the metric was at least 55%. If a similar pattern follows now as well, then the crypto may have potential for more downtrend before the bottom is finally in.

BTC Price

At the time of writing, Bitcoin’s price floats around $19.2k, down 33% in the last seven days. Over the past month, the crypto has lost 37% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have plunged down over the past day | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com