Bitcoin mining profitability has plummeted by more than 75% from the market peak, and is now at its lowest level since October 2020.

Bitcoin Price Plummets Further

Bitcoin’s price plummeted to a 52-week low of $20,800 on Wednesday, down from an all-time high of $68,788 by more than 70%. Despite the fact that the price has already returned above $21,000, important market indications indicate that bears still have a strong grip on the current market.

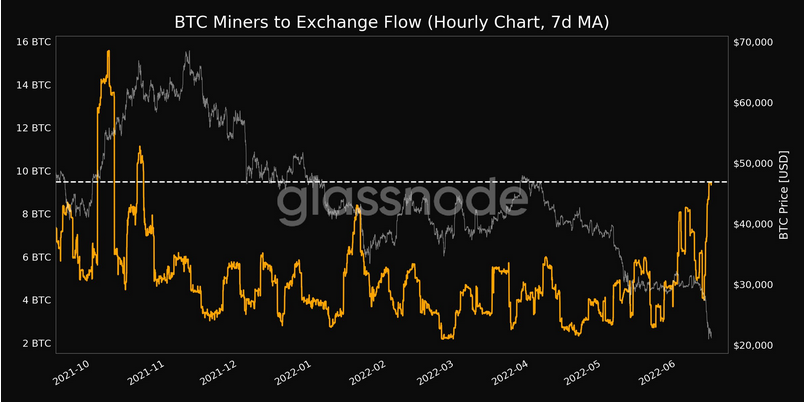

The Bitcoin Miners to Exchange Flow, a metric that measures the amount of BTC transferred from miners to crypto exchanges, hit a seven-month high of 9,476. The increase in exchange flows suggests that miners are selling their BTC in anticipation of a price drop.

BTC miners'exchange flow. Source: Glassnode.

Related article | Exchange Inflows Ramp Up As Crypto Investors Clamor To Exit Market

Miners Actions Signals Market Sentiment

BTC miners’ activities often mirror broader market sentiment, as they typically sell BTC to avoid losing money on their mining payouts. The large drop in mining profitability explains the increase in Bitcoin miners selling activity.

Mining profitability has plummeted by more than 75% since its peak, and Bitcoin’s hash price is at $0.0950/TH/day, the lowest since October 2020.

BTC/USD falls to a 52-week low. Source: TradingView

The netflow of miners to exchanges has also improved. When the miner netflow is positive, it means that more coins are being transmitted to exchanges than to individual wallets. This type of activity indicates that miners are negative on the price and are feeling pressured to sell.

With the price of BTC falling below $21,000, many BTC mining rigs have become unprofitable and may be shut down if the price does not recover. As the whole market value went below $1 trillion, the rest of the crypto market followed BTC’s price behavior.

BTC has gone through a number of bull cycles in the last decade, each followed by an 80%-90% drop from its peak. The BTC price, on the other hand, has never gone below the previous cycle’s all-time high. BTC is currently trading at its 2017 high of $19,783, and any sell-off from here might drive it back into 2017 territory.

Related article | TA: Bitcoin Shows Signs of Recovery, $23K Presents Resistance

Featured image from Getty Images, chart from TradingView.com