TLDR

Bitcoin price dropped nearly 5% from $65,000-$66,000 resistance zone in October

Analyst predicts Bitcoin could reach $90,000 in 2 months if it follows global M2 money supply trend

Global liquidity is rising, partly due to weakening USD

China’s monetary policy changes are driving global M2 money supply expansion

Federal Reserve hints at further rate cuts in Q4 2024

Bitcoin, the world’s leading cryptocurrency, has experienced a slight downturn at the start of October, dropping nearly 5% from the $65,000 to $66,000 resistance zone.

Despite this short-term setback, some analysts remain optimistic about Bitcoin’s future price trajectory, citing global liquidity trends as a potential catalyst for growth.

One analyst on social media platform X (formerly Twitter) has drawn attention to the correlation between Bitcoin’s price and the global M2 money supply.

M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money. According to this analyst, if Bitcoin continues to track the global M2 money supply trend, it could potentially reach $90,000 within the next two months.

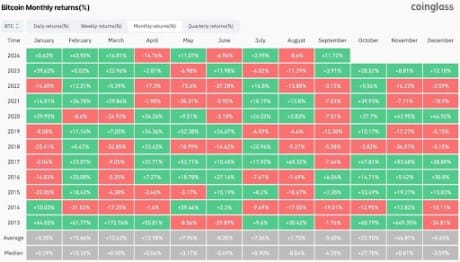

The theory behind this prediction is based on historical data showing a direct correlation between increases in global money supply and Bitcoin price movements.

If bitcoin continues following the trajectory of global M2 money supply, it’s heading to $90,000 before the end of the year. pic.twitter.com/Kd3YlDT12H

— Joe Consorti ⚡️ (@JoeConsorti) September 30, 2024

As global liquidity rises, Bitcoin has often seen corresponding price increases. Currently, global liquidity is on an upward trend, which could bode well for Bitcoin’s price if this correlation holds true.

In the short term, Bitcoin faces resistance at the September 2024 highs of around $65,000 to $66,000. If bullish sentiment returns and prices rise, Bitcoin might break through this resistance. Further resistance lies between $70,000 and $72,000.

A breakout above these levels could potentially trigger a short squeeze, possibly pushing Bitcoin beyond its previous all-time high set in March.

The recent uptick in global liquidity can be attributed to several factors, with China’s monetary policy changes playing a significant role.

The People’s Bank of China (PBoC) has recently cut interest rates and plans to inject billions into the economy to stimulate growth.

China’s M2 money supply is larger than that of the United States in USD terms, making it a primary driver of global M2 money supply expansion.

Lots of talk about Global M2 with words like “exploding”, “breaking out”, “skyrocketing”, etc. So I looked under the hood. VERY mixed bag. Some thoughts:

One aspect of rising Global M2 is due to the falling dollar, as other nations’ money supplies rise in dollar terms while USD… pic.twitter.com/LA7ThtjXfb

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) September 29, 2024

Another factor contributing to the rise in global liquidity is the weakening of the US dollar. When the money supply of major economies like Japan, China, or the European Union increases in USD terms, it tends to lead to a decline in the value of the dollar. This, in turn, results in a valuation change in the global M2 money supply.

The United States Federal Reserve’s monetary policy is also a key factor to consider. After a period of tightening to curb inflation from 2022, the Fed is now showing signs of easing.

In September, the central bank cut rates by 50 basis points. Federal Reserve Chair Jerome Powell has hinted at the possibility of further rate cuts in the fourth quarter of 2024. This shift in policy could potentially benefit Bitcoin and other risk-on assets.

It’s important to note that while these global liquidity trends may influence Bitcoin’s price, the cryptocurrency market is known for its volatility and can be affected by a wide range of factors.

These include regulatory changes, technological developments, market sentiment, and macroeconomic conditions.

For Bitcoin, the immediate focus remains on breaking through the resistance levels between $65,000 and $72,000. A successful breach of these levels could pave the way for further price appreciation, potentially validating the bullish predictions based on global liquidity trends.