BlackRock’s filing for a Bitcoin spot ETF (iShares Bitcoin Trust) has breathed new life into the market and sparked a strong rally. The hope is that BlackRock will trigger a “Great Accumulation Race” around Bitcoin, fuelled by the fact that 69% of all investors have been unwilling to sell their Bitcoins for over a year, Bitcoinist reported.

Market experts give the BlackRock ETF a high chance of approval. Remarkably, BlackRock has an approval ratio of 575:1, but the US Securities and Exchange Commission’s (SEC) ratio when it comes to rejecting Bitcoin spot ETFs is just as clear: 33:0.

But because BlackRock has close ties to US regulators and Democratic politicians, there is room for an optimistic outlook on the likelihood of approval. As K33 Research writes in their latest market analysis, BlackRock is unlikely to spend time and resources if they do not see the chance of approval as very high.

Race For The First Bitcoin Spot ETF

Rumors have already emerged in recent days that BlackRock’s ETF filing could be decided within “days to weeks”, NewsBTC reported. But what are the exact deadlines? The SEC’s regulations provide a clue.

The important thing to know here is that the deadlines for the SEC and its decision on the iShares Bitcoin Trust depend on when the application is published in the Federal Register for comments. Since this has not officially happened yet, there are only approximate estimates so far.

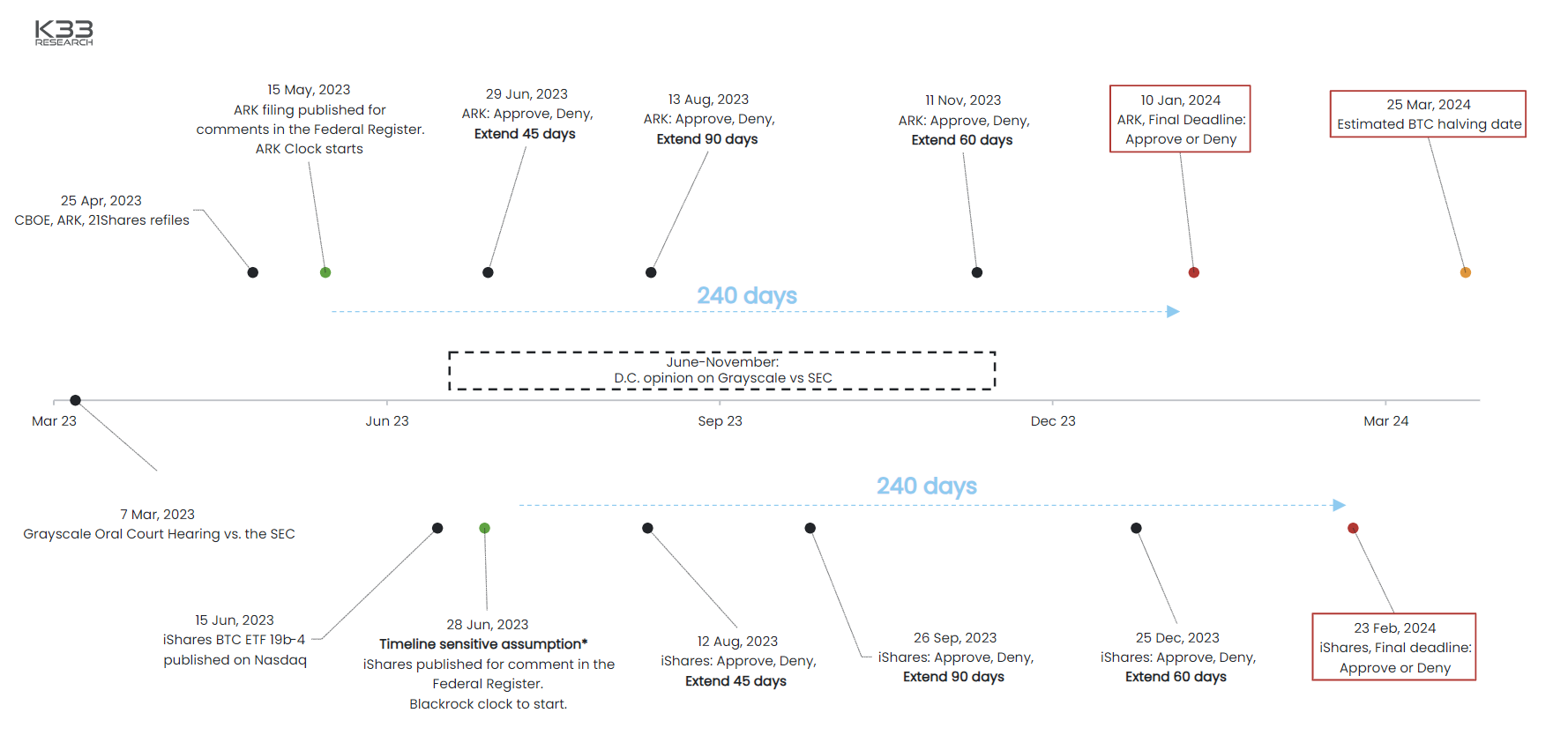

Nevertheless, K33 Research has drawn up a rough timeline based on the SEC’s deadlines. Theoretically, a decision can be reached within four time intervals, with the decision process following a scheme of anchored decision dates.

After publication of the application in the Federal Register, the SEC has 45 days in the first time interval to approve, reject or extend review of the ETF. Assuming the application is published in the Register on June 29, the SEC’s first deadline would be August 12, 2023. Similar inflection points occur 45 days later, 90 days later and 60 days later.

When BlackRock #Bitcoin spot ETF?

Timeline depends on the publication in the Federal Register. Assuming July 29:

August 12: Extend 45 days

September 26: Extend 90 days

December 25: Extend 60 days

Final deadline: February 23, 2024.h/t @K33Research

More details 👇

— Jake Simmons (@realJakeSimmons) June 22, 2023

K33 Research states that the SEC must announce a decision after 240 days at the latest. This means that the market will have a decision by February 23, 2024 at the latest (may be shifted by a few days depending on the publication in the Federal Register).

Will Grayscale Or CBOE Preempt BlackRock?

Even though everyone is currently talking about BlackRock’s ETF filing, there is a possibility that two other institutions will get approval, or at least a decision on their matters, before the world’s largest asset manager.

As K33 Research shows in its ETF schedule, the CBOE filed its “ARK 21Shares” before BlackRock and could potentially benefit from BlackRock’s momentum. Already on May 9, Cboe Global Markets filed to list and trade shares of a spot Bitcoin ETF from Cathie Woods Ark Invest and crypto investment product firm 21 on the Cboe BZX exchange.

In addition, Grayscale could also receive a ruling ahead of BlackRock in its legal battle with the SEC. A final ruling on Grayscale’s lawsuit could be imminent. The final judgment is expected three to six months after the hearing. The hearing was held on March 7, 2023. The core of Grayscale’s lawsuit is that the SEC acted arbitrarily in approving futures-based ETFs and rejecting spot ETFs.

As K33 Research discusses, all market participants are currently in a race for first mover advantage. The launch of ProShares BITO clearly demonstrated this advantage. BITO saw $1bn in inflows two days after launch. To date, BITO has a 93% market share among futures-based long BTC ETFs.

However, whoever wins the race, it seems clear at the moment that Bitcoin investors will be the winners. Head of resaerch at CryptoQuant, Julio Moreno, recently shared the chart below and commented: “Here’s what happens when a big fund [Grayscale’s GBTC] increases Bitcoin demand.

At press time, the BTC price has taken a breather above $30,000 after yesterday’s rally and was trading at $30,150.

Featured image from ETF Database, chart from TradingView.com