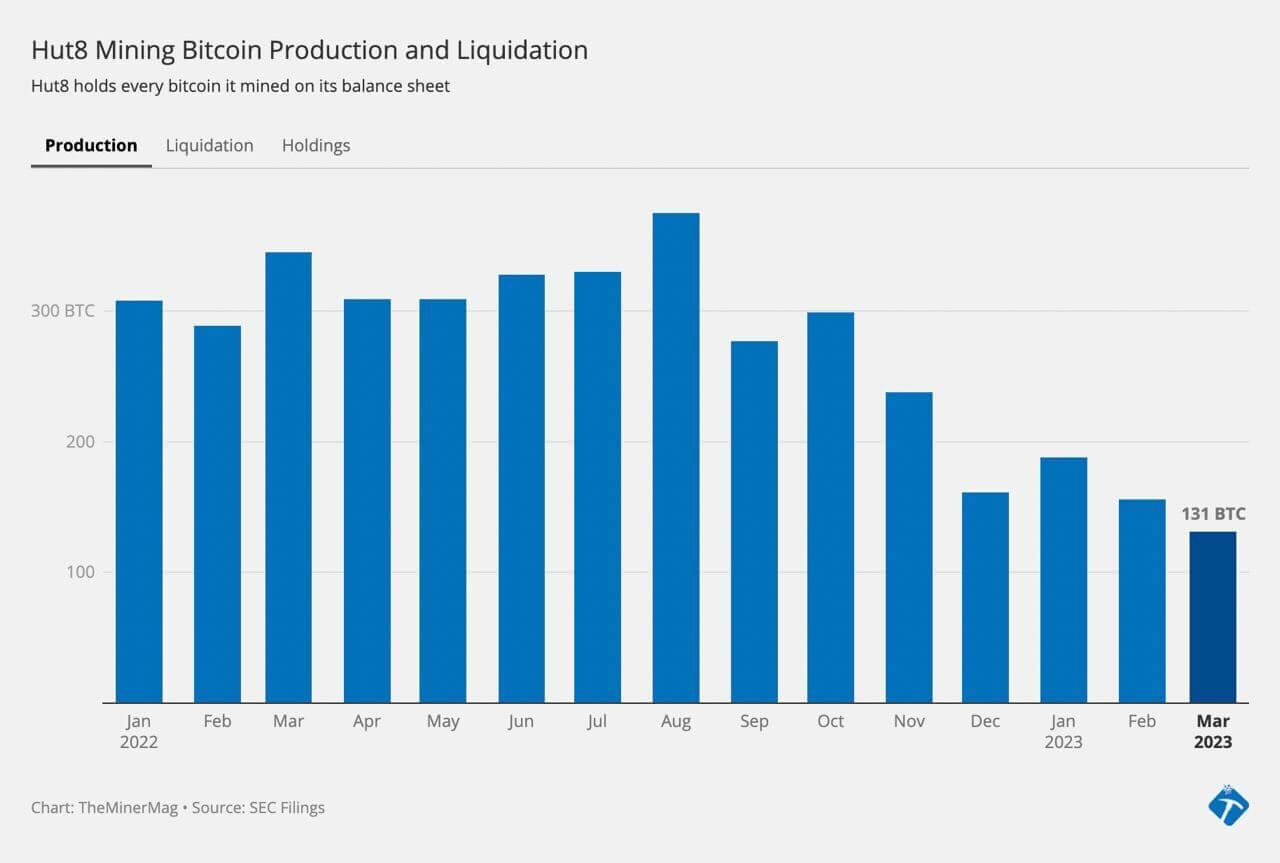

Bitcoin miner Hut 8’s mined BTC declined 30% during the first quarter as its production fell to 131 BTC in March from 188 BTC recorded in January.

According to theminermag data, the BTC miner produced 475 BTC during the quarter. Its realized hashrate also fell from 1.72 to 1.44.

Hut8 sold all BTC it mined in February

Hut 8 said it sold 240 BTC — all the BTC it produced in February and part of the 131 BTC it mined in March — according to an April 5 press statement.

In March, the BTC miner said it produced an average of 4.2 BTC per day and 50.38 BTC/EH despite mining difficulty increasing by 10.67% month over month. The firm noted that the increasing difficulty showed “the growing demand and strength of the Bitcoin network.”

Despite selling some of its BTC, Hut8 holds one of the largest amounts — 9,133 BTC — of self-mined Bitcoin in reserve for publicly-traded companies.

The Canadian firm’s hashrate capacity for its Alberta facilities reached 2.6 EH/s at the end of the month. For its Medicine Hat site, it added 1,000 miners to increase the hash rate to an all-time high of 1.72 EH/s.

It added that it had started remediation testing for its Drumheller site in Alberta.

Speaking on the development, CEO Jaime Leverton said the firm is currently focused on two things:

“Remediating the challenges at our Drumheller site, and closing the transaction with USBTC.”

Despite meeting operational milestones, Hut8 stock is down 1.4% in the last 24 hours to $1.75. However, the stock is up 12.18% over the past month. The miner’s stock is also one of the best gainers among public miners, increasing 106% on the year-to-date metrics.

The post Hut8’s Bitcoin production decreased 30% in Q1 appeared first on CryptoSlate.