On-chain data shows the Bitcoin leverage ratio has surged up to a new all-time high, suggesting the market could be heading towards high volatility.

Bitcoin All Exchanges Estimated Leverage Ratio Sets New ATH

As pointed out by a CryptoQuant post, the funding rate has remained neutral while the leverage has increased in the market.

The “all exchanges estimated leverage ratio” is an indicator that measures the ratio between the Bitcoin open interest and the derivative exchange reserve.

What this metric tells us is the average amount of leverage currently being used by investors in the BTC futures market.

When the value of this indicator is high, it means users are taking a lot of leverage right now. Historically, such values have led to higher volatility in the price of the crypto.

On the other hand, the value of the metric being low suggests investors aren’t taking high risk at the moment, as they haven’t used much leverage.

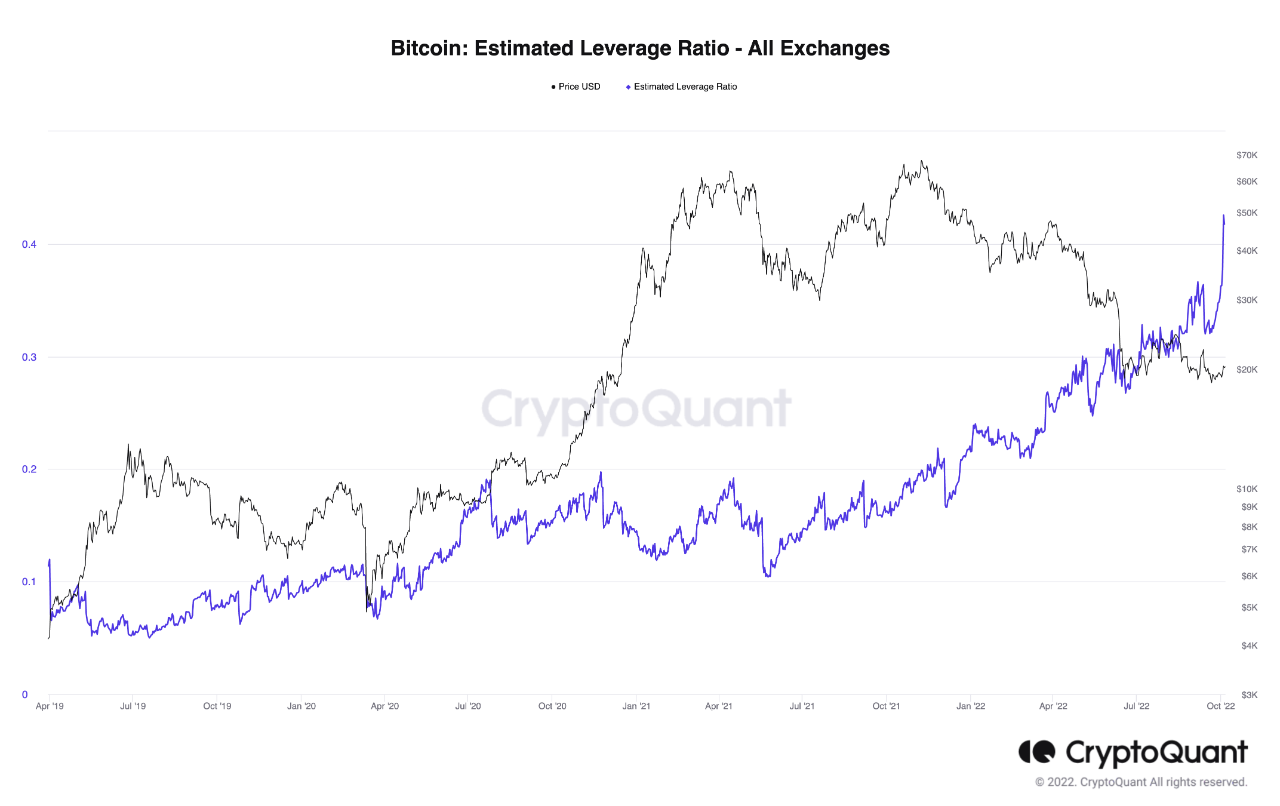

Now, here is a chart that shows the trend in the Bitcoin leverage ratio over the last few years:

Looks like the value of the metric has been rising up during the last few months | Source: CryptoQuant

As you can see in the above graph, the Bitcoin estimated leverage ratio has shot up recently and has attained a new ATH. This means that investors are taking a high amount of leverage on average.

The reason overleveraged markets have usually turned highly volatile in the past lies in the fact that such conditions lead to mass liquidations becoming more probable.

Any sudden swings in the price during periods of high leverage can lead to a lot of contracts getting liquidated at once. But it doesn’t end there; these liquidations further amplify the price move that created them, and hence cause even more liquidations.

Liquidations cascading together in such a way is called a “squeeze.” Such events can involve either longs or shorts.

The Bitcoin funding rates (the periodic fee exchanged between long and short traders) can give us an idea about which direction a possible squeeze may go in.

CryptoQuant notes that this metric has a neutral value currently, implying the market is equally divided between shorts and longs. As such, it’s hard to say anything about the direction a possible squeeze in the near future might lean towards.

The Bitcoin volatility has in fact been very low in recent weeks, but with such high accumulation of leverage, it may be a matter of time before a volatile price takes over.

BTC Price

At the time of writing, Bitcoin’s price floats around $19.6k, up 2% in the past week.

The BTC value continues to trend sideways | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com