Ethereum has experienced a mild setback after breaking the important barrier at $2,000 and continues to trade in the green over today’s trading session. The cryptocurrency is leading the current crypto market relief and sees poised for further gains.

At the time of writing, Ethereum (ETH) trades at $1,980 with a 6% and 15% profit over the last 24 hours and 7 days, respectively. Only Solana (SOL), and Cardano (ADA) come close to ETH’s price gains with double digits profits over the same period.

Trading firm QCP Capital believes the bullish momentum is on track to extend on the back of positive macro-economic factors. The crypto relief rally took off last week when the U.S. published the Consumer Price Index (CPI) July print, a measure of inflation in the dollar.

The metric stood at around 8.5% and, as QCP Capital said, “confirms the peak inflation narrative”. Thus, market participants expect a less aggressive Federal Reserve (Fed) as inflation appears to be trending down. The trading desk said:

This has led to the market pricing a more dovish Fed, creating bullish momentum that is likely to continue until the next FOMC meeting on 22 September.

In the coming weeks, there are other macro-economic events that could negatively impact market participants’ perceptions about the Fed. However, QCP Capital believes the market will “remain supported regardless”.

For the price of Ethereum, the bullish narrative is double as there is a tentative date for the mainnet implementation of “The Merge”, the event that will complete ETH transition to a Proof-of-Stake (PoS) consensus. The event is expected to take place between September 15 to 16.

This has led to an “unprecedented” shift in the crypto options markets, the total open interest (OI) for ETH contracts has overshadowed Bitcoin (BTC) open interest. The former stands at $8 billion and the latter at $5 billion.

What Could Become An Obstacle For Ethereum’s Bullish Momentum

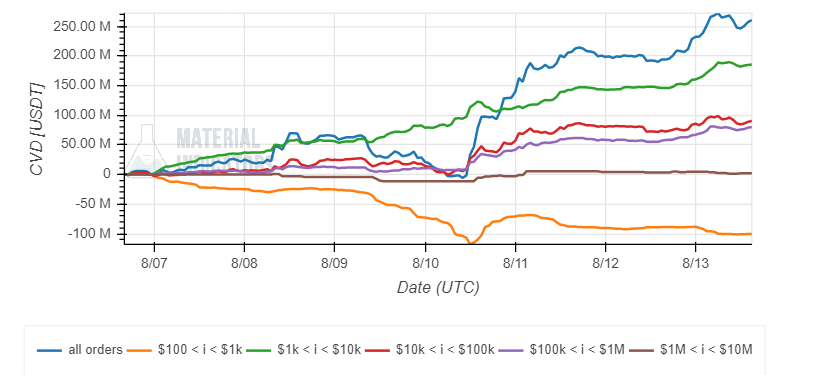

The above might suggest market participants are buying call (buy) options for Ethereum heading into “The Merge”, counting on the event to be successful. In the spot market, data from Material Indicators shows that investors with bid orders from $1,000 to $100,000 have been buying into ETH’s price action over the last week.

If large investors continue to support Ethereum, the bullish momentum could sustain, as QCP Capital expects. However, Bitcoin should see more upward pressure to support any long-term bullish price action, as NewsBTC previously reported.

Additional data provided by Material Indicators records thin resistance for ETH’s price, on low timeframes, north of $2,050. If bulls can push the price beyond those levels, ETH could reclaim its previous highs and turn critical resistance into support.