On-chain data shows the Bitcoin exchange whale ratio has started to sharply rise, a sign that these humongous holders may be beginning to dump.

Whales Are Behind Almost 90% Of Bitcoin Exchange Inflows Right Now

As pointed out by an analyst in a CryptoQuant post, whales may be ramping up dumping, a sign that could be bearish for the price of BTC.

The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions to exchanges and the total exchange inflows.

Since the 10 biggest transactions to exchanges usually belong to the whales, this metric can tell us about the relative size of whale inflows to the rest of the market.

When the value of this metric is high (that is, above 85%), it means whales currently make up a very large part of the overall exchange inflows.

Especially high values can suggest that whales are mass dumping at the moment, something that could prove to be bearish for the price of Bitcoin.

On the other hand, the indicator having values lesser than 85% can imply whale selling in the market is at a healthy level right now. During bull runs, the metric usually remains in this range.

Related Reading | Bitcoin Market Plunges Into Extreme Fear, How Scary Does It Get?

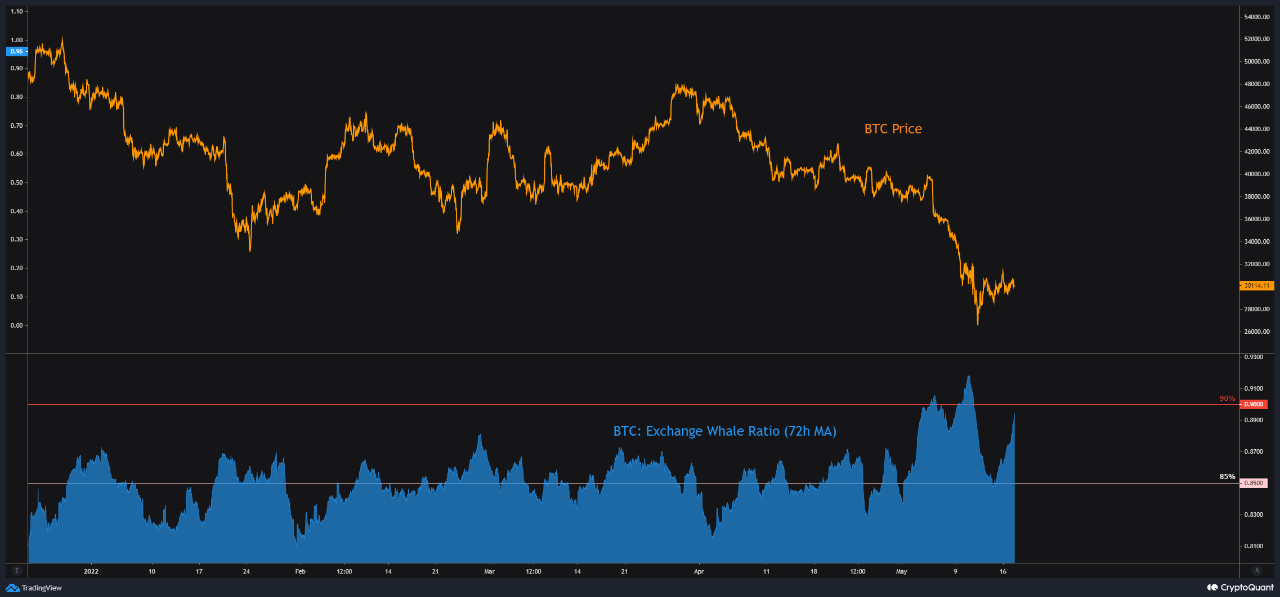

Now, here is a chart that shows the trend in the Bitcoin exchange whale ratio (72-hour MA) over the course of 2022 so far:

The indicator's value seems to have surged up recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin exchange whale ratio has shot up and is now approaching the 90% mark.

This suggests that whales may be starting to ramp up their dumping right now. Earlier in the month, the ratio exceeded the 90% point and the coin’s price plummeted down to below $26k.

Related Reading | New Data Shows China Still Controls 21% Of The Global Bitcoin Mining Hashrate

If the indicator keeps rising and a similar trend follows this time as well, then more downside could be in store for the cryptocurrency.

BTC Price

At the time of writing, Bitcoin’s price floats around $29.7k, down 6% in the last seven days. Over the past month, the crypto has lost 25% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the price of the crypto has mostly moved sideways over the past few days | Source: BTCUSD on TradingView

Since Bitcoin’s quick rebound back above the $30k level from the crash down to below $26k, the coin hasn’t shown much movement.

At the moment, it’s unclear when BTC may break out of this consolidation that it has been stuck in during the past week.

Featured image from Unsplash.com, charts from TradingVIew.com, CryptoQuant.com