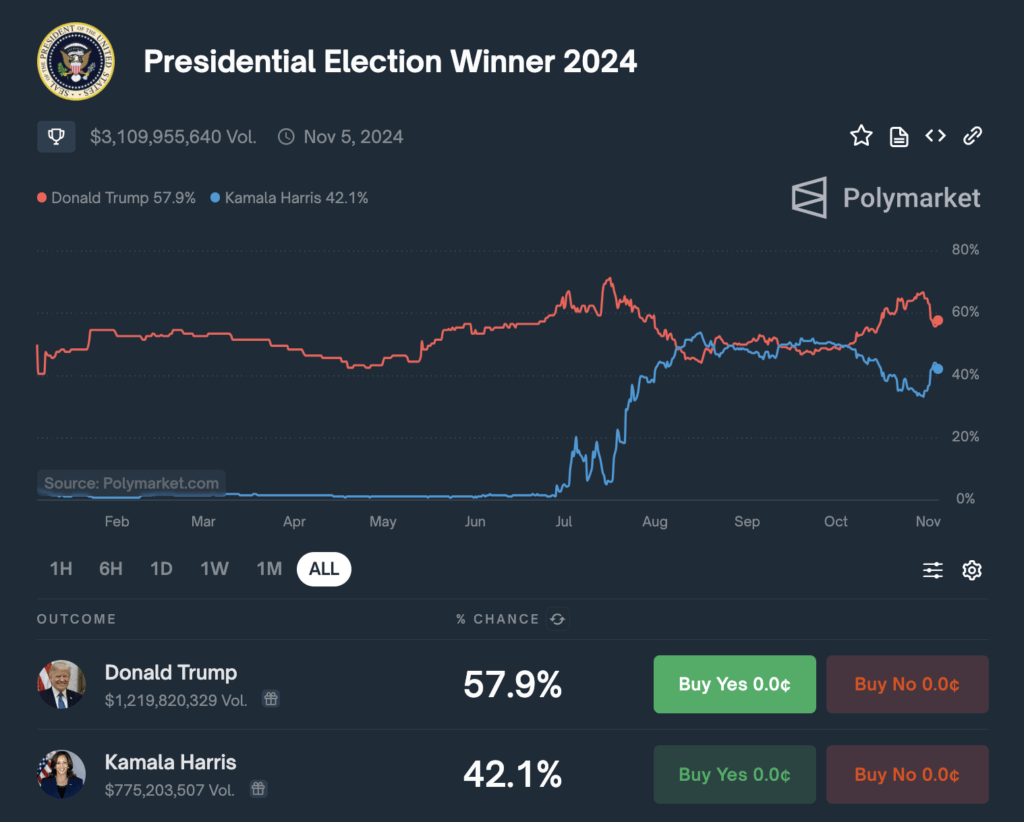

Polymarket’s leading holder of Trump shares has shifted, with ‘zxgngl’ surpassing ‘Fredi9999’ after significant buying activity on Monday morning amid shortening odds over the weekend. On Sunday Trump’s lead narrowed from 65% to 54% as whale pressure subsided.

Whales persistently purchasing Trump shares regardless of price appear to have reduced their activity, leading to a contraction in his lead over Harris. On Sunday, the odds tightened to Trump at 54% versus Harris at 46%, but the trend reversed slightly by Monday.

As of press time, Trump’s odds are 57%, with Harris at 42%.

Several whales increased positions in October, consistently buying up the order book even when the price reached as high as $0.66. However, with prices dropping by $0.12 over the weekend, many whales were unwilling to add to positions.

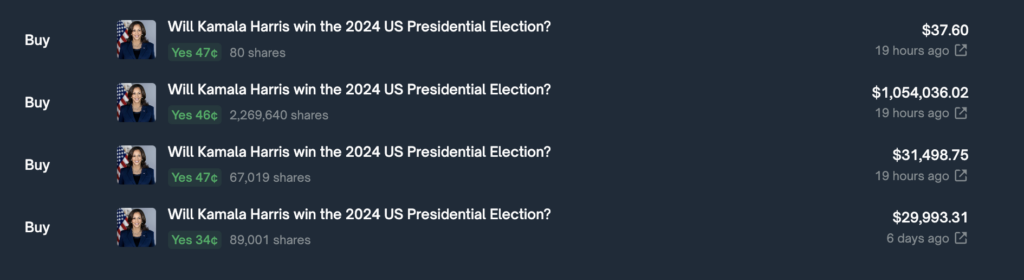

The leading Harris supporter, ‘leier,’ placed over $4 million in bets after Harris’ price surged from $0.33 to $0.47. Having only put $29,993 on Harris at $0.34, ‘leier’ decided to increase their position after the odds narrowed substantially. As of press time, ‘leier’ sits on a $416,013 unrealized loss.

However, on Monday morning, ‘zxgngl’ and ‘larpas’ took the opportunity to purchase shares at the reduced price, helping to push Trump up by around $0.03.

Following aggressive buying over the past month, many top holders face unrealized losses. Only ‘larpas’ and ‘zxgngl’ have purchased shares within the past five days, while others have refrained from new positions for up to two weeks.

| Username | Wallet Address | Joined | Positions Value | Profit/Loss | Volume Traded | Markets Traded |

|---|---|---|---|---|---|---|

| zxgngl | 0xd235…0f29 | Oct 2024 | $12,948,153.76 | -$895,068.71 | $21,465,527.63 | 2 |

| GCottrell93 | 0x94a4…6356 | Oct 2024 | $7,670,524.24 | -$1,138,226.10 | $13,282,293.06 | 1 |

| Theo4 | 0x5668…5839 | Oct 2024 | $14,899,351.39 | -$2,890,014.72 | $40,277,373.15 | 13 |

| PrincessCaro | 0x8119…f887 | Sep 2024 | $6,190,145.31 | $80,957.34 | $23,520,809.95 | 14 |

| Michie | 0xed22…3dd0 | Oct 2024 | $3,761,940.18 | $131,874.00 | $8,450,962.77 | 13 |

| larpas | 0xe43c…01ad | Jul 2024 | $4,452,987.72 | -$62,387.08 | $8,498,926.94 | 24 |

| Fredi9999 | 0x1f2d…d0cf | Jun 2024 | $16,350,230.30 | $96,221.14 | $76,611,316.91 | 45 |

The combined profit/loss for the top seven Trump holders currently stands at $-4,676,643.

Trump supporters such as ‘zxgngl’, who joined Polymarket in October, hold positions valued at $12,948,153 with a profit/loss of -$895,068, trading a volume of $21,465,527 across two markets. Similarly, ‘GCottrell93’ has positions worth $7,670,524 with a loss of $1,138,226, and ‘Theo4’ holds $14,899,351 in positions with a loss of $2,890,014.

As previously reported, whales like ‘Fredi9999’ and ‘PrincessCaro’ actively supported Trump’s odds through high-frequency trading throughout the last month. At one point, they executed over 1,600 trades totaling more than $4 million within 24 hours, significantly influencing market trends. One of the newest entrants, ‘Theo4’, placed over $12 million in high-frequency bets on Trump within three days, quickly becoming one of the top holders.

Market depth shifts amid election certification fears

Market depth data previously indicated a lack of liquidity around current price levels, with only about $4 million in sell orders between the current price and $0.99. This thin order book implied that relatively modest buy or sell orders could substantially impact Trump’s perceived odds on Polymarket.

However, the order book has changed substantially, with $12 million in sell orders now below $0.99. Further, a new market to bet on who will be inaugurated has been created amid concerns about whether there will be legal challenges to the election results. Traders have increasingly opened sell orders below $1 to capitalize on gains should the market face issues with final resolutions.

For instance, if Trump’s odds rise to $0.93, $5 million in liquidity will be sold, with users opting to make gains before the result is officially confirmed. The $5 million level will be reached for Harris if her odds increase to $0.98. According to Polymarket’s terms, the market resolves,

“When the Associated Press, Fox, and NBC all call the election for the same candidate. In the unlikely event that doesn’t happen, the market will remain open until inauguration and resolve to whoever gets inaugurated.”

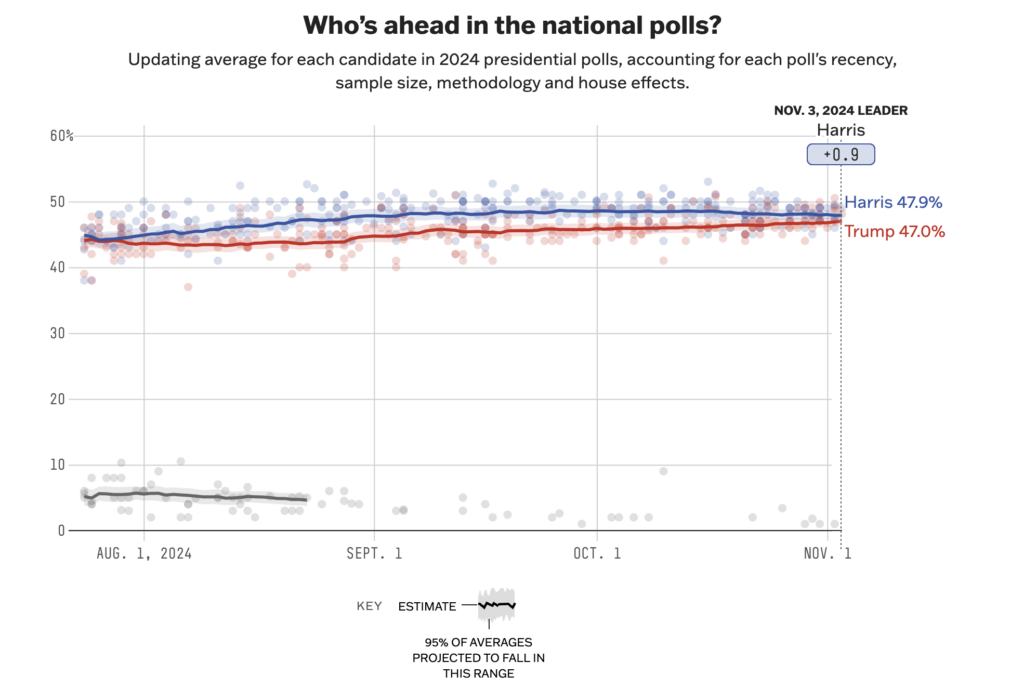

Will Trump whales take advantage of the reduced cost to back the former President for tomorrow’s election, or will Polymarket odds move closer to polling figures that see the race as neck and neck?

The post Polymarket odds narrow sharply as whales slow down Trump betting appeared first on Crypto Finders