Following last week’s launch of 11 spot Bitcoin exchange Traded-Funds (ETFs) in the United States, Matt Hougan, Chief Investment Officer (CIO) at Bitwise, has offered a compelling perspective on the potential impact of these ETFs on the Bitcoin market. His remarks come at a critical juncture, with the next Bitcoin halving event anticipated in mid-April 2024.

Spot ETFs Could Have Impact Like 1.4 Bitcoin Halvings

Hougan draws a parallel between the impact of Bitcoin ETFs and the Bitcoin halving events. He states, “Crypto natives have a good mental model for the impact of Bitcoin ETFs on the market: The halving.” He further explains the historical context, “Roughly every four years, the amount of new bitcoin being created falls in half. Bitcoin’s price has historically risen in the year +/- surrounding the halving.”

In April, when the block number hits 740,000, the reward will fall from 6.25 to 3.125 BTC. Highlighting the supply-demand dynamics of Bitcoin, Hougan remarks, “Bitcoin’s price is set by supply and demand. If you reduce new supply, that should be (and historically has been) good for prices.” He then quantifies the impact of the next halving, “At current prices, it will remove approximately $7 billion in new supply from the market each year.”

Moving to the core of his analysis, Hougan compares the expected inflows from ETFs to the halving effect. He notes that estimates for ETF inflows vary, but many people think that these products will pull in somewhere around $10 billion per year for the foreseeable future.

“If that happens, that means the direct impact of the ETF on Bitcoin’s supply/demand balance is something like 1.4 halvings,” Hougan claims.

However, he cautions about the timing of these impacts, saying:

Note that ‘halvings’ don’t impact prices overnight. If the next halving takes place on April 22, we don’t expect prices to increase sharply on April 23. Historically, prices have risen in +/- the year surrounding each halving. The same will be true for ETFs.

An Even Greater Scope?

Hougan also highlights the indirect benefits of ETFs. According to him, these products could have indirect benefits that aren’t captured in his analogy. “IMHO, the ETF is a significant positive for regulation, long-term education, etc. It will substantially increase the number of people interested in crypto, and therefore have a multiplier effect.”

Concluding his thoughts, Hougan says, “Still, the halving is a pretty good mental model for the direct impact of ETFs: ~1.4 halvings, plus the significant ancillary benefits. We’ll take it.”

Hougan’s estimate of $10 billion per year of net inflows for the spot Bitcoin ETFs is quite conservative. Analysts from Standard Chartered predicted a few days ago that there will be inflows of $50 billion to $100 billion this year. If $100 billion does indeed flow into the ETFs, the products could even have an impact as strong as 14 BTC halvings.

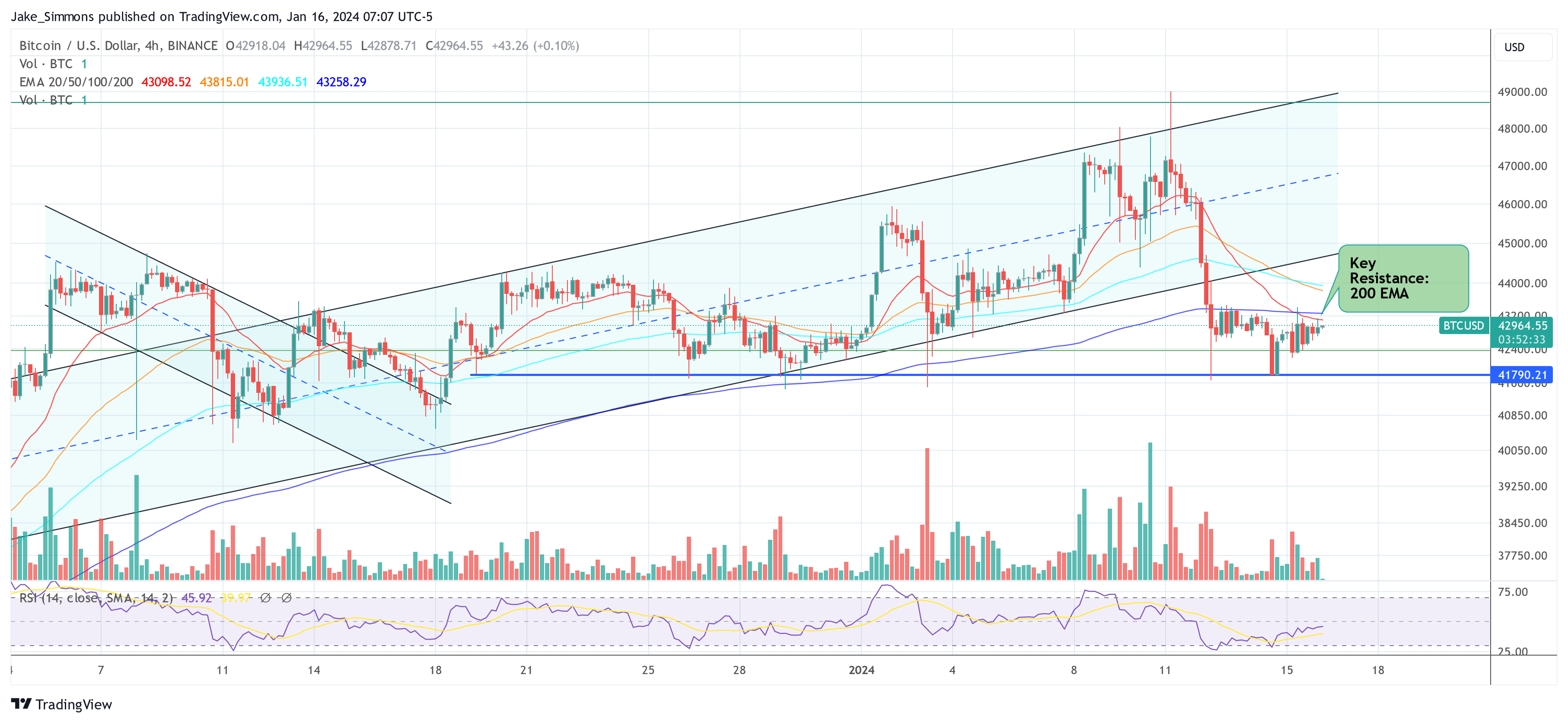

At press time, BTC traded 42,964.

Featured image created with DALL·E 3, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.