TLDR

Bitcoin surged to $66,000, causing $233 million in crypto derivatives liquidations

Short positions were hit hard, with $198 million in shorts liquidated

The rally affected other cryptocurrencies, with Ethereum and Solana outperforming Bitcoin

A “three-line break chart” suggests Bitcoin may be headed for record highs above $73,000

The daily candlestick chart still shows Bitcoin trapped in a descending channel since March

Bitcoin has made a significant move, climbing to $66,000 and causing a stir in the cryptocurrency market. This price surge has led to substantial liquidations in the crypto derivatives sector, with short positions taking the brunt of the impact.

Over the past 24 hours, Bitcoin’s price jumped by about 6%, reaching levels not seen since late September. This rally wasn’t isolated to Bitcoin alone.

Other cryptocurrencies followed suit, with Ethereum and Solana even outperforming Bitcoin, posting gains of 8% and 7% respectively.

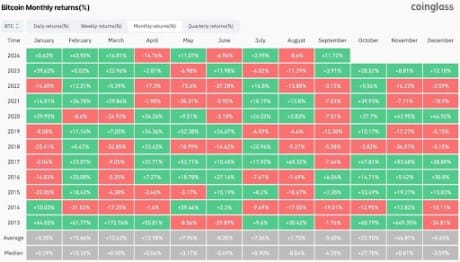

The sudden price movement triggered a wave of liquidations in the cryptocurrency derivatives market. Data from CoinGlass shows that a total of $233 million worth of crypto derivative contracts were liquidated during this period.

Notably, short positions, which bet on price decreases, suffered the most. These bearish bets accounted for $198 million of the liquidations, representing about 85% of the total.

Bitcoin-related contracts led the liquidations, accounting for 39% of the total. Ethereum came in second, while other cryptocurrencies like Solana, SUI, and NEIRO also saw significant liquidations.

This event, known as a “short squeeze,” occurs when a rapid price increase forces traders holding short positions to buy back the asset to cover their positions, further driving up the price.

The feedback loop created by these forced buybacks can lead to increased volatility and more dramatic price movements.

While the daily price charts show Bitcoin still trapped in a descending channel that has been in place since March, some analysts are looking at alternative charting methods for a potentially more bullish outlook.

The “three-line break chart,” which aims to filter out market noise and focus on trend changes, suggests that Bitcoin may be poised for further gains.

According to chartered market technician Steve Nison, this charting method can be more responsive to market dynamics than traditional charts.

The current three-line break chart for Bitcoin shows a bullish breakout from the descending channel, potentially signaling the resumption of the broader uptrend that began in October 2023.

If this bullish interpretation proves correct, Bitcoin could be headed towards new all-time highs above the previous record of around $73,000.

However, traders should remain cautious, as the traditional candlestick chart still shows significant resistance around the $70,000 level.