TLDR

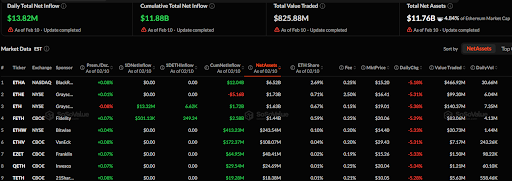

Total daily net inflow for Ethereum ETFs was $13.82M, with cumulative inflows at $11.88B.

Grayscale’s ETH ETF registered a $13.32M inflow, while FETH posted $501K.

ETHA, ETHE, and ETHW recorded no flow changes, maintaining steady cumulative inflows.

ETHV, EZET, QETH, and TETH had stable flows, with no daily inflows or outflows.

Total net assets across Ethereum ETFs amounted to $11.76B, representing 4.84% of Ethereum’s market capitalization.

According to a recent SoSoValue update as of February 10, the total daily net inflow for all Ethereum ETFs stood at $13.82 million, while the cumulative total net inflow amounted to $11.88 billion. The total value traded reached $825.88 million, and the total net assets across all Ethereum ETFs were valued at $11.76 billion, representing 4.84% of the Ethereum market cap.

Grayscale’s ETH and FETH ETFs Report $13.32M and $501K Inflows

Tracking the performance of individual Ethereum ETFs, ETH traded on the NYSE under Grayscale registered an inflow of $13.32M. The ETH ETF reached a cumulative net inflow of $1.72B and net assets of $1.63B. ETH reflected an ETH share of 0.67% with a 0.15% fee.

FETH, listed on CBOE under Fidelity, posted an inflow of $501.13K. FETH achieved a cumulative net inflow of $2.58B and net assets of $1.44B. FETH accounted for an ETH share of 0.59% with a 0.25% fee.

ETHA, ETHE, ETHW Report No Flow Changes

ETHA, traded on NASDAQ under BlackRock, recorded zero flows. ETHA maintained a cumulative net inflow of $12.04B and net assets of $6.52B.

ETHE, listed on the NYSE under Grayscale, posted no changes in the flows. The ETHE ETF carried a cumulative net inflow of -$5.16B and net assets of $1.73B. ETHE showed an ETH share of 0.71% and charged a 2.50% fee. ETHE ended at $16.41 with a daily loss of 5.31%.

ETHW on the NYSE under Bitwise recorded no zero inflow or outflow. ETHW accumulated a cumulative net inflow of $413.23M and net assets of $243.54M. ETHW represented an ETH share of 0.10% with a 0.20% fee.

ETHV, EZET, QETH, and TETH Join the Stable Inflows List

ETHV on CBOE under VanEck posted no inflow or outflow but reported a cumulative net inflow of $172.37M. ETHV held an ETH share of 0.04% and charged a 0.20% fee. ETHV ended at $29.43 after a 5.31% decrease.

EZET on CBOE under Franklin recorded no inflow or outflow with a cumulative net inflow of $64.95M and net assets of $40.41M. EZET reflected an ETH share of 0.02% with a 0.19% fee. EZET closed at $15.26 after a 5.33% decline. EZET traded at $1.50M with 98.22K in volume.

QETH on CBOE under Invesco posted a stable flow, with no inflows or outflows. QETH Ethereum ETF registered a cumulative net inflow of $29.54M and net assets of $24.69M. QETH carried an ETH share of 0.01% and charged a 0.25% fee. TETH on the CBOE under 21Shares recorded no inflows or outflows. TETH ETF accumulated a cumulative net inflow of $19.28M and net assets of $18.38M.